In Minnesota’s divided state legislature, a transportation issue that has received bipartisan support: dramatically raising the registration fee for electric vehicles (EVs) from $75 a year to $200 a year. Unfortunately, this is a short-sighted policy for both current and future EV owners and Minnesotans seeking a meaningful solution to our transportation funding shortfall.

On the surface, raising the EV registration fee may sound like it makes sense. Most people know that the gas tax helps to pay for our roads and that fully electric vehicles don’t pay gas taxes. Given this, it’s understandable to assume that EVs are getting a ‘free ride’ when it comes to paying for our roads and bridges — but digging deeper reveals the truth of this misperception. In reality, EVs pay their fair share through a combination of other tax revenue streams.

Only 35 percent of road construction and maintenance is funded from gas taxes in Minnesota. Most of our infrastructure funding comes from tab fees, vehicle sales taxes, and general fund revenues — not gas taxes. EV drivers pay these other kinds of taxes, and in fact tend to pay more than equivalent gas-powered cars. This offsets the lost gasoline tax revenues.

Since EVs are still less than 1% of passenger vehicles in Minnesota, dramatically increasing the EV registration fee is not going to plug the bigger holes in roadway funding caused by inflation, aging infrastructure, and increasing gasoline vehicle efficiency. What raising the annual EV registration fee from $75 to $200 will do is make it more expensive to switch to EVs, particularly for under-resourced Minnesotans at a time when the number of affordable used vehicles is increasing. Add to that the precarious federal policy landscape surrounding the future of EVs, and this legislative proposal risks hampering our state’s ability to reach its greenhouse gas reduction goals for its #1 climate-polluting sector, transportation.

What lawmakers, state agencies, advocates, businesses, and others need to do instead is find a comprehensive solution to a complex problem, that considers all fuel and vehicle types.

Read on to learn more about how EVs pay toward our current roadway funding and dive into the details of some potential solutions.

How much do EVs (and gas-powered vehicles) pay toward roadway funding?

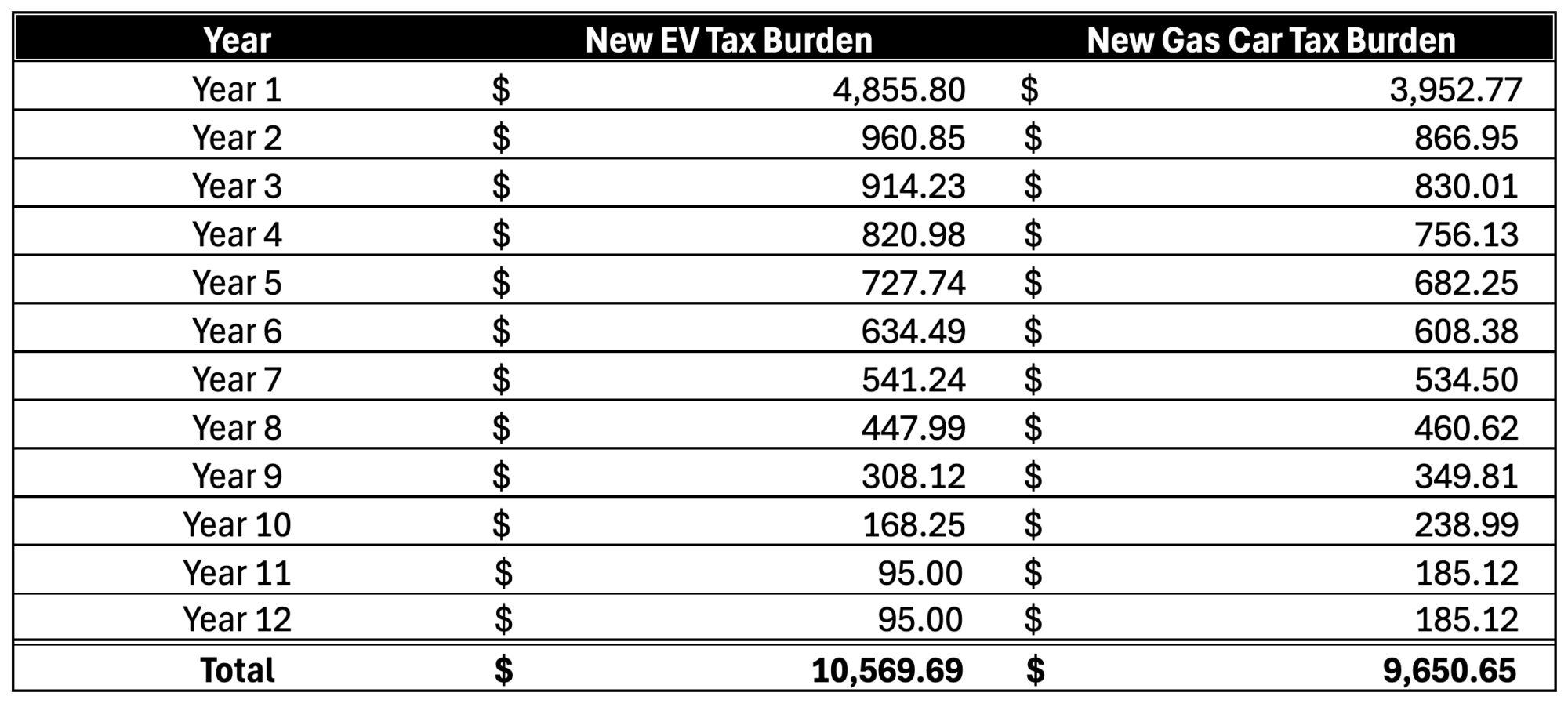

As discussed, Minnesota’s roadways are funded through the gas tax as well as the motor vehicle sales tax, tab fees, and general fund revenues. Although the purchase price difference has narrowed over the years, EVs on average still have higher price tags than gasoline vehicles. Since Minnesota’s sales tax and tab fees scale proportionally to the retail price of the vehicle, EVs pay much higher taxes than gas vehicles, especially in the earlier years of ownership. In fact, after accounting for all relevant sources, the tax burdens for the average gas and electric vehicles are surprisingly comparable over a 12-year lifespan.

As EVs become more affordable, this gap will narrow. However, this analysis does not consider several important factors. Most notably: vehicle efficiency.

More efficient vehicles pay less, except EVs

One of the benefits of the gas tax is that it encourages people to adopt more fuel-efficient vehicles. That helps reduce air pollution and climate emissions, and helps people save money on fuel and taxes. For example, compare the annual fuel tax burden from driving an average number of miles for the most popular vehicle of 2024, a Ford F150 (19 miles per gallon, or MPG) to the most popular sedan, a Toyota Camry (51 MPG).

Minnesota’s EVs currently pay a registration fee of $75 per year, which is similar to what a Toyota Camry owner who drives an average amount pays in gas taxes in a year. However, an EV can be over twice as efficient as a Camry! But how can we compare such different fuel types?

An EV’s efficiency can be converted to ‘Miles per Gallon Equivalent’ (MPGe), and most models perform at above 100 MPGe, since electric motors are incredibly energy efficient. If we applied the same logic that dictates that more efficient gas cars should pay less in taxes, then shouldn’t EVs pay even less? At 100 MPG a typical driver would pay only $43 in gas taxes in a year. If electric vehicles paid the gas tax instead of a registration fee, they’d save money!

Requiring drivers to pay $75 dollars to drive an EV instead of $43 isn’t terribly punitive, but raising the annual fee to $200 would be unfair to drivers that are trying to make a healthier and climate-friendly choice that benefits everyone.

Cool math, but how are we going to pay for our roads?

We still need to address funding gaps for transportation. As we mentioned above, EVs represent less than 1 percent of on-road vehicles in Minnesota, so even with disproportionately high taxes they will not be able to solve our highway funding problems on their own.

Gas taxes and EV registration fees together create an incomplete and unfair stop-gap solution that only vaguely approximates a ‘user-fee’ to fund our roadways. The gas tax incentivizes drivers to switch to more efficient vehicles, but it doesn’t adequately tax the road-use of efficient gas cars. On the other hand, EV registration fees are too simplistic and charge drivers that use roads only a little the same as those drivers that drive a lot, which is regressive.

A more nuanced policy solution being studied is to impose a tax on all vehicles based on the number of miles they drive, regardless of the fuel they use. This policy, called a Vehicle-Miles Traveled tax or a Distance-Based Fee, shows promise. By treating fossil-fueled cars and electric vehicles the same under this tax regime, we could be sure that everyone is paying their fair share without having to do nearly as much algebra.

However, it is important for us to keep in mind the widespread benefits that the decarbonization of our transportation system will have for everyone. A technologically agnostic distance-based fee would be a missed opportunity to continue to incentivize the transition to zero-emission vehicles and promote the use of transit systems in our state, which are both critical to equitably reducing our greenhouse gas emissions from transportation.

Raising the EV registration fee is neither fair nor a real solution to funding our transportation infrastructure. Regardless of what legislators decide, electrifying our transportation system will remain a necessary step toward achieving Minnesota’s climate goals, one which we need state policies to support, not hamper. With your help, Fresh Energy will continue to working with lawmakers to identify ways to fund our roads while keeping sustainable transportation solutions affordable for all Minnesotans and meeting our state’s climate goals.