In a nutshell:

– Hydrogen demand is driven by use in oil refining, ammonia production, methanol production, and iron and steel making.

– There are many types of ways to produce hydrogen, but some production methods continue using fossil gas and others require additional research and consideration of environmental justice concerns.

– Green hydrogen is the most promising technology for deep decarbonization of the industrial sector.

– Hydrogen could play a role in the deep decarbonization of the industrial sector.

– State and federal programs and funding are underway to further explore hydrogen production in Minnesota and beyond.

It’s official, Minnesota’s electricity supply will be 100% carbon-free by 2040. For years the production of electricity has been the number one emitter of greenhouse gases (GHGs) in Minnesota and nationally, so the decarbonization of Minnesota’s electricity sector is worth celebrating. It sets the clean energy foundation for meeting Minnesota’s and Fresh Energy’s goal of economy-wide carbon neutrality by 2050.

However, to avoid the worst impacts of climate change, we must now turn our attention to other sectors of the economy. At Fresh Energy, we’ve been working on decarbonizing buildings and the transportation sector for years, but we’re also moving forward to confront emissions from the industrial sector. As part of this work, Fresh Energy is evaluating the role hydrogen can play in building a carbon-neutral economy.

Fresh Energy is not alone in assessing hydrogen’s potential for deep decarbonization. The fuel has long been a source of hope for the development of a pollution-free economy—in 2003 President George W. Bush launched the Hydrogen Fuel Initiative with the goal of powering U.S. cars, trucks, homes, and businesses with hydrogen.

Technological advancements and the passage of the Infrastructure Investment and Jobs Act (IIJA) and the Inflation Reduction Act (IRA) mean that we are actually on the cusp of the long-awaited hydrogen economy. However, not all forms of hydrogen are created equal, and neither are all uses of hydrogen.

In this blog post, we’ll discuss technologies for producing hydrogen, federal and state hydrogen initiatives, promising and not-so-promising uses for hydrogen, and how Fresh Energy is diving into the hydrogen conversation.

What’s hydrogen?

At its most basic level, hydrogen is the world’s most abundant chemical element (it’s denoted by the symbol H). And at the risk of stating the obvious, hydrogen is a building block for water and all living things. Hydrogen is also a critical component of fossil fuels.

While hydrogen is all around us, naturally occurring hydrogen gas (H2) is scarce. Currently, hydrogen demand is driven by use in oil refining, ammonia production, methanol production, and iron and steel making. The vast majority of the hydrogen used in these industries is produced from fossil fuels and is very carbon intensive.

Hydrogen has long held promise as a climate solution because, unlike fossil fuels, hydrogen does not emit carbon dioxide when combusted. The major byproduct of combusting hydrogen is water vapor, but it’s important to note the combustion of hydrogen can result in the emission of nitrogen oxides (NOx). NOx is a harmful air pollutant that can cause respiratory issues in humans and is a key component in the formation of ground-level ozone or smog. While hydrogen use holds potential as a climate solution, any discussion of hydrogen for deep decarbonization must also consider how hydrogen is produced and the potential for GHG emissions from that production mode.

Turn Awareness Into Action

Our clean energy future needs you. Take the next step and sign up for Powering Progress!

Our monthly e-newsletter keeps you informed, inspired, and ready to take action for a sustainable future.

Sign Up TodayColors of the hydrogen rainbow

At Fresh Energy, we’ve described the production methods for hydrogen as a “kaleidoscope of colors” and it feels like new modes of hydrogen production (and new colors) keep creeping into the picture. In this section, we will detail some of the most commonly discussed methods of hydrogen production. It’s worth noting that the color system is simply a description for the technology pathway used and the colors have been known to change and new shades are sometimes added. Fresh Energy is committed to assessing new technologies as they come online.

Gray

Gray hydrogen is hydrogen produced from fossil gas using the steam-methane reforming (SMR) method. In this process, high-temperature steam is reacted with methane (CH4) in the presence of a catalyst under pressure to create hydrogen and carbon monoxide. After the initial reaction, the carbon monoxide is reacted with water to create even more hydrogen and carbon dioxide. The SMR process is the most common hydrogen production method in the world—95% of hydrogen produced in the U.S. is from SMR. The SMR process is also a significant driver of industrial emissions globally, and fossil gas’ role in the process means gray hydrogen is not a viable climate solution.

Blue

Blue hydrogen utilizes the same process as gray hydrogen, but the carbon emissions are captured and then sequestered or used in other processes. The continued use of fossil gas as a feedstock for blue hydrogen also makes it problematic as a climate solution.

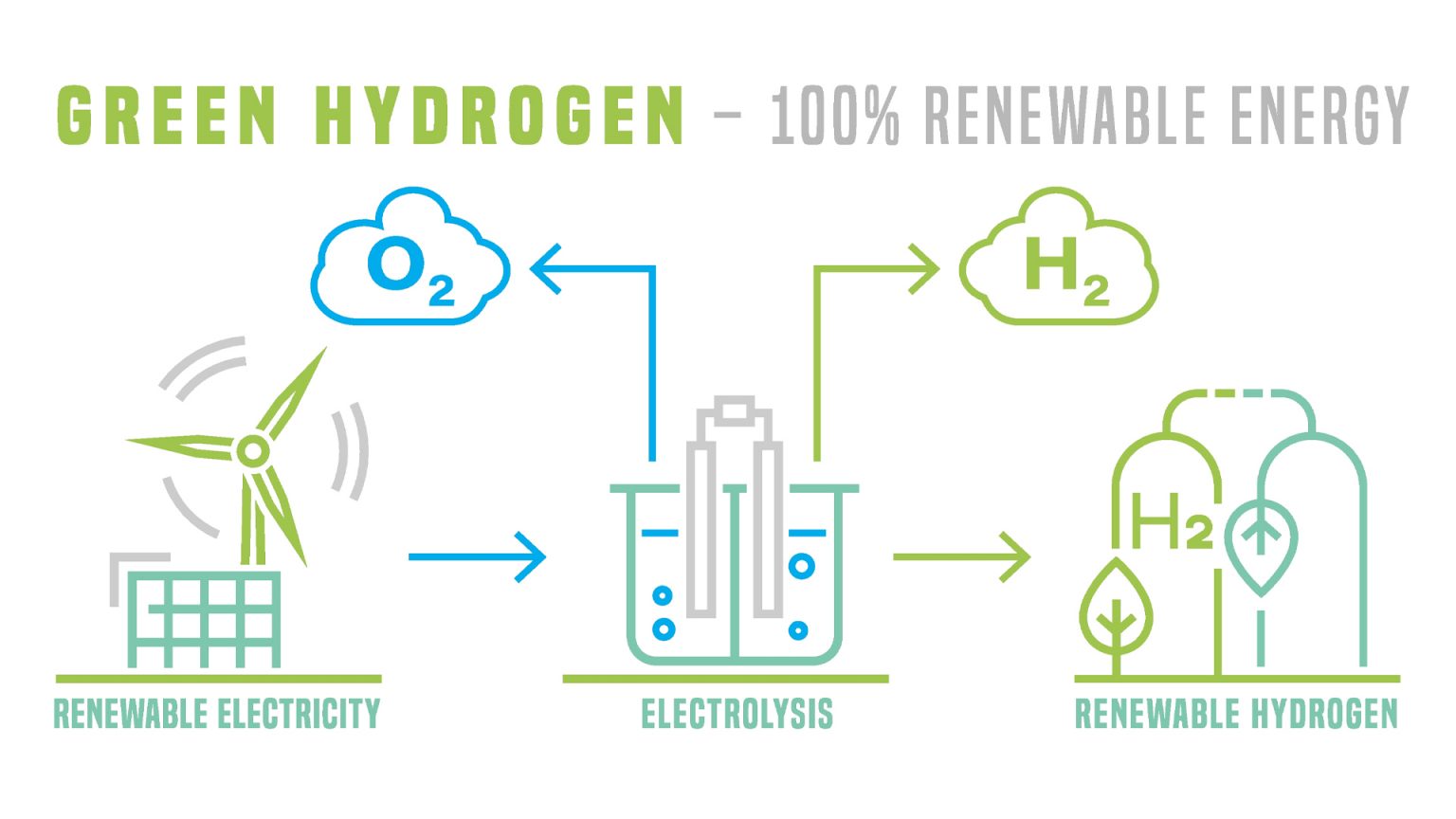

Green

At its core, green hydrogen is the production of hydrogen gas using carbon-free renewable electricity (wind, solar, or hydropower). The process utilizes renewable electricity to power an electrolyzer, which separates water into hydrogen gas and oxygen. Green hydrogen production does not emit any carbon dioxide (however, there is embodied carbon in the materials used to build renewable energy infrastructure and electrolyzers). As green hydrogen is deployed at scale, water availability and water use impacts will also need to be assessed. Green hydrogen consumes nine liters of water per kilogram of hydrogen produced; hydrogen produced by steam methane reforming consumes about 22 liters of water per kilogram of hydrogen. At Fresh Energy, we believe green hydrogen is the most promising technology for producing hydrogen and meeting our climate goals. As we grow our Industry Department, we will be placing further emphasis on green hydrogen.

Pink, red, and purple

Pink, red, and purple hydrogen are all generated with nuclear power. Pink hydrogen, like green hydrogen, is produced by powering an electrolyzer with electricity from nuclear power. Red hydrogen uses the thermal energy from nuclear power to create hydrogen by splitting water in the presence of a catalyst. Purple hydrogen is created by chemo-thermal electrolysis of water from nuclear power. While these processes don’t emit carbon dioxide, the equity, health, and environmental justice issues surrounding nuclear waste storage and disposal are critical to consider when weighing applications of nuclear power for hydrogen production.

Turquoise

Turquoise hydrogen uses methane as a feedstock, like gray and blue hydrogen, but differs from the SMR process. Turquoise hydrogen uses pyrolysis, a process where high heat and a catalyst, like nickel, iron, cobalt, and carbon, are used to break down methane into hydrogen gas and a solid carbon byproduct. There are no carbon dioxide emissions from this process. Turquoise hydrogen is a younger process and is still being researched. The technology currently appears to be less energy efficient than either gray and green hydrogen. However, the fact that fossil gas is the feedstock means that issues of emissions from fossil gas production and leaks in the natural gas system remain.

Brown or black

Brown or black hydrogen is produced through the gasification of coal. Brown hydrogen refers to using lignite, while black hydrogen refers to using bituminous coal. Gasification is an established industrial process and it’s known to generate significant carbon dioxide emissions—it is even more carbon intensive than the SMR process.

White

Also known as natural or geologic hydrogen, white hydrogen refers to molecular hydrogen that’s naturally found in underground deposits, especially in areas with iron-rich minerals. It is produced through natural geochemical processes and can be extracted via drilling. While its natural occurrence suggests a low-carbon footprint and possible low-cost, the feasibility and environmental impact of large-scale extraction remains under study.

Orange

Orange hydrogen involves injecting carbon dioxide-enriched water into iron-rich geological formations, like those found in northern Minnesota. This process triggers a chemical reaction that generates hydrogen while simultaneously sequestering carbon dioxide, providing a possible win-win to both produce cleaner hydrogen and store carbon underground to mitigate the worst effects of climate change.

Gold

Gold hydrogen refers to extracting naturally occurring hydrogen that is produced through microbial activity in specific conditions, such as depleted oil wells. Some methods of extraction are exploring the potential for injecting an oil well with bacteria and nutrients, which then processes the residual oil into hydrogen and carbon dioxide that can then be recovered. This method repurposes legacy fossil fuel assets.

If hydrogen holds so much promise for decarbonizing, why aren’t we using it now?

The promise of hydrogen as a real solution for climate change will hinge on the ability of industry and policymakers to scale the production of price-competitive, decarbonized hydrogen and the ability of the market to transform. Like other commodities, hydrogen’s price is subject to price volatility, especially when fossil gas is used as a feedstock. Currently, the price of gray hydrogen is considerably lower than green hydrogen. The price of gray hydrogen is around $1.50 per kilogram (kg), while the price of green hydrogen is around $5 per kg. The price of blue hydrogen typically lands between these two price points. Fortunately, the federal government is prioritizing work to make cleaner sources of hydrogen cost competitive with gray hydrogen.

IIJA, IRA, and the Hydrogen Shot

In June 2021, the U.S. Department of Energy (DOE) announced its Hydrogen Shot and set the goal of producing clean hydrogen for $1 per kg within one decade. This effort was turbocharged in November 2021 when the Infrastructure Investment and Jobs Act (IIJA) was passed into law – fun fact: the IIJA is also known as the Bipartisan Infrastructure Law (BIL) and the two are used interchangeably. The IIJA contains $9.5 billion for clean hydrogen. After the passage of the IIJA, the federal government doubled down when it passed the August 2022 Inflation Reduction Act (IRA), including significant hydrogen tax credits for hydrogen production. Furthering the DOE’s hydrogen work was the September 2022 release of its draft National Clean Hydrogen Strategy and Roadmap, which provides a picture of the U.S.’s current hydrogen industry, barriers to decarbonizing hydrogen, and how DOE is working to advance the industry.

The IIJA and IRA contain several notable hydrogen-specific programs and initiatives that have received media attention and are poised to help develop commercial-scale clean hydrogen. It’s important to note, the DOE and Congress want to see a diverse set of feedstocks and technology being developed, which is why the DOE uses the broad term “clean” hydrogen. Some of the hydrogen-producing technologies that will receive DOE funding will also emit carbon dioxide and could rely on fossil gas as a feedstock, but DOE is working to set a carbon intensity standard for hydrogen production that will inform their funding decisions—draft guidance in September 2022 proposed a lifecycle GHG emissions standard of 4 kg of carbon dioxide equivalent (CO2e) emitted per kilogram of hydrogen produced. This figure is consistent with the standard contained in the IRA. As discussed more below, the clean hydrogen incentives funded through the IIJA and IRA encourage lower-emitting technologies.

Key IIJA hydrogen provisions

Regional Clean Hydrogen Hubs Program ($8 billion)

The hallmark of the IIJA’s hydrogen provisions is the establishment of a program to develop six to 10 regional clean hydrogen hubs to spur investment in communities and clean energy, create family-sustaining jobs, and improve energy security. Per the IIJA, the DOE is “to the extent practicable” supposed to select hubs with diverse feedstocks – including fossil fuels, nuclear power, and renewable energy – and in diverse geographic locations. At least two hubs are supposed to be located in areas with abundant fossil gas resources. The program is also supposed to seek a diversity in end-uses, including hydrogen use in the power generation sector, transportation sector, residential and commercial heating, and in industry.

Clean Hydrogen Electrolysis Program ($1 billion)

This program aims to reduce the costs for producing hydrogen utilizing electrolyzers. Bringing down the cost of electrolyzers is a key driver for reducing the cost of green and turquoise hydrogen, and this program has the potential to benefit an existing Minnesota business. In October 2022, Cummins, Inc. announced plans to convert part of its Fridley, Minnesota, plant to manufacture electrolyzers.

Clean Hydrogen Manufacturing Recycling Program ($500 million)

The Clean Hydrogen Manufacturing Recycling Program seeks to increase the efficiency and cost-effectiveness of recovering raw materials used in clean hydrogen technology. Per the DOE, the program will also work on building public acceptance for recycling hydrogen fuel cells.

Key IRA hydrogen provisions

With the IRA, the U.S. government has committed to subsidizing the production of clean hydrogen through tax credits. These tax credits are commonly known as the 45V, Section 48, and 45Q tax credits in reference to their location in the Internal Revenue Code. These credits work to reduce the cost differential between clean hydrogen and gray hydrogen. With the exception of the 45Q tax credit, the hydrogen tax credits are technology neutral. Importantly, under the 45V and Section 48 tax credits, the amount of the credit is based on the lifecycle emissions of the hydrogen being produced.

Section 45V hydrogen production tax credits

This production tax credit sets up a sliding tax credit that clean hydrogen producers can receive based on the lifecycle emissions of the hydrogen produced. Under the 45V scale, green hydrogen from carbon-free renewables would receive the maximum production tax credit amount ($3/kg) while current blue hydrogen technologies, if they qualify at all, would likely qualify for the lowest credit amount ($0.60/kg). The 45V tax credit is available to projects that begin construction before 2033 and is available for 10 years after a project is placed in service. In order to receive the full amount, a project must also meet certain prevailing wage and apprenticeship requirements. Projects that don’t meet prevailing wage and apprenticeship requirements are subject to a lower tax credit amount.

| Lifecycle GHG Emissions (kilogram CO2e/kilogram H2) | Production Tax Credit Full Value ($/kilogram) |

|---|---|

| 4-2.5 | $0.60 |

| 2.5-1.5 | $0.75 |

| 1.5-0.45 | $1.00 |

| 0.45-0 | $3.00 |

Section 48 investment tax credits for energy production

The IRA also amended an existing investment tax credit for energy production to include hydrogen. The section 48 tax credit allows hydrogen projects to receive an investment tax credit for a fraction of their capital expenses. Similar to the 45V credit, the lower the lifecycle emissions, the higher the tax credit. Projects are eligible for this credit if they begin construction before 2033. There are also prevailing wage and apprenticeship provisions that must be met to receive the full amount.

| Lifecycle GHG Emissions (kilogram CO2e/kilogram H2) | Investment Tax Credit Full Value (% of capital expenses) |

|---|---|

| 4-2.5 | 6% |

| 2.5-1.5 | 7.5% |

| 1.5-0.45 | 10% |

| 0.45-0 | 30% |

Section 45Q tax credit for carbon sequestration

In addition to creating hydrogen-specific tax credits, the IRA also increased an existing tax credit for projects utilizing carbon capture or direct air capture (DAC) technologies, which has applications for blue hydrogen methodologies. Under the 45Q tax credit, a hydrogen production facility using carbon capture technology could be eligible for payments based on the endpoint of the captured carbon, but the facility must capture at least 12,500 metric tons of carbon dioxide per year. Projects utilizing DAC must capture at least 1,000 tons of carbon dioxide per year. Like 45V and Section 48, there are prevailing wage and apprenticeships requirements to receive the full amount and qualified facilities must begin construction prior to 2033 to be eligible.

| Type of Sequestration | 45Q Tax Credit Full Value |

|---|---|

| Carbon captured for enhanced oil recovery (EOR) or utilization | $60 per metric ton |

| Carbon capture and sequestration | $85 per metric ton |

| DAC for EOR or utilization | $130 per metric ton |

| DAC and sequestration | $180 per metric ton |

While these three tax credits can help lower clean hydrogen’s production cost, it’s important to note that the tax credits cannot be stacked. A clean hydrogen project will need to pick which credit to utilize, which will be unique to each project.

Fresh Energy believes that green hydrogen is where we must focus our efforts in order to reach a carbon-neutral economy by 2050. Production methods that utilize fossil gas and tax credits that support enhanced oil recovery (EOR) have the potential to limit our ability to achieve a carbon-neutral economy by 2050.

Walz Administration hydrogen efforts

Here in Minnesota, the Walz-Flanagan Administration and the Department of Commerce have been working to take advantage of the new federal programs and develop a clean hydrogen economy. In October 2022, Governor Walz issued Executive Order 22-22, directing state agencies to pursue federal funding to develop clean hydrogen markets in Minnesota in consultation with Tribal Nations and key stakeholders.

Minnesota also joined others states in two separate Memoranda of Understanding (MOU) to work together on creating a Midwestern hydrogen industry. In October 2022, Minnesota joined with governors from North Dakota, Montana, and Wisconsin to develop a hydrogen hub (the Heartland Hydrogen Hub) application that will be led out of the University of North Dakota’s Energy and Environmental Research Center. And in September 2022, Minnesota joined with Illinois, Indiana, Kentucky, Michigan, Ohio, and Wisconsin in signing an MOU to develop a “Midwestern hydrogen ecosystem.” Fresh Energy will be engaging with the Administration and the Department to see where these initiatives go and finding opportunities to plug in.

Fresh Energy and hydrogen

Fresh Energy’s mission is to shape and drive bold policy solutions to achieve equitable carbon-neutral economies. To organize and guide our work we’ve created five strategic imperatives, and as is the case with many emerging issues and technologies in the climate space, hydrogen cuts across our imperatives and departments. To achieve this mission, the use of green hydrogen in strategic, hard-to-abate end uses and where production and consumption can be co-located is Fresh Energy’s gold standard.

While production technologies aside from green hydrogen may be an incremental improvement over current gray hydrogen, Fresh Energy has concerns regarding the continued use of fossil gas to produce hydrogen because of the known issues with leakage across the fossil gas process chain, which negates some of the climate benefits of blue hydrogen. Other production modes, like pink hydrogen, are carbon-free, but the expense and feasibility of using nuclear power needs additional research. The issue of nuclear waste storage and its historic environmental injustice must also be addressed as part of any conversation around pink hydrogen.

In terms of using green hydrogen, Fresh Energy is especially excited for opportunities to deploy green hydrogen in the industrial sector in hard-to-abate end uses and for limited use in other sectors. Hard-to-abate end uses are applications where electrification is technically impossible, or the cost of electrification is so high that electrification is essentially impossible. Critically, the co-location of green hydrogen production and consumption will provide opportunities for economic development and ensure climate and environmental benefits are not eroded. As end-use technologies are developed and deployed, we will be monitoring how green hydrogen is transported and confronting the trade-offs associated with transporting hydrogen and hydrogen-containing materials, like ammonia.

Industrial applications we’re particularly excited about are using green hydrogen in the production of green ammonia and green fertilizers. Here in Minnesota, the University of Minnesota’s West Central Research and Outreach Center, led by Mike Reese, has pioneered the use of wind power to create green ammonia. The local production and use of green ammonia for fertilizer could have real benefits to Minnesota’s farmers, rural economy, and our climate, and it is something we’re excited to work on in 2023 and beyond. We’re also excited about the use of hydrogen to create process heat in industrial applications where electrification isn’t possible and in chemical processes, such as steel production in electric arc furnaces.

Blending hydrogen into existing natural gas distribution systems for commercial and residential use has been top of mind in Minnesota and nationally. And Fresh Energy is on the record as saying we don’t believe using green hydrogen in buildings is the best use of the fuel. Blending any hydrogen, even green hydrogen, into the existing gas delivery system can lead to issues where pipelines crack and become embrittled, leading to natural gas leakages and increased human exposure to air-polluting, combustible gas. There is also an upper limit to the amount of hydrogen that can be blended into existing infrastructure, above which it is unsafe to distribute and use in current appliances. Fresh Energy has long advocated for electrifying everything possible in our buildings. Electric appliances and heating/cooling systems have numerous climate and human health benefits, in addition to being a lower-cost option for decarbonizing our buildings. Recognizing that other sectors of the economy cannot be as readily electrified, green hydrogen is best paired with harder-to-abate end uses to maximize the speed and scale of economy-wide decarbonization.

In the transportation sector, there may be some viable solutions as part of developing a carbon-neutral economy by 2050, including long-distance surface, air, and marine travel. As green hydrogen-based technologies develop, Fresh Energy’s transportation department will continue to monitor the advances while promoting electrification as a long-term solution for most on-road and off-road surface transportation.

As mentioned above, Minnesota has passed a 100% carbon-free electricity standard with a 2040 deadline. This nation-leading standard means that all carbon-free technologies will need to be assessed to ensure Minnesota can meet the new law’s obligations. In assessing those future technologies, green hydrogen may have a role to play in solutions like direct hydrogen combustion or long-duration energy storage.

As always, when it comes to advancing policies and strategies related to hydrogen production and use, Fresh Energy will follow the science, our mission, and work in partnership. We look forward to sharing more thoughts on industrial decarbonization and high-value use cases for green hydrogen as the technology and policymaking conversation evolves.