Fresh Energy and other CEOs’ modeling finds Xcel should build more renewables and storage, leverage existing power plants instead of overbuilding new gas “peaker” plants

At Fresh Energy, we are committed to ensuring Minnesota remains on track toward a clean energy future by midcentury. This includes participating in regulatory work such as Xcel Energy’s Integrated Resource Plan (IRP) with the Minnesota Public Utilities Commission (PUC). Our recent analysis, conducted with our partners as the Clean Energy Organizations (CEOs) — a group consisting of Fresh Energy, Clean Grid Alliance (CGA), Minnesota Center for Environmental Advocacy (MCEA), and Sierra Club – demonstrates that Xcel should deploy more renewables and storage, while leveraging existing gas plants, instead of Xcel’s proposed plan which would add six new gas plants by 2030.

Integrated Resource Plans are long-term plans that Minnesota’s electric utilities file with the Commission every two years to show how they plan to meet their customers’ energy needs and what investments in electricity generation assets they plan to make. Then, the utility, the Commission, and advocates like Fresh Energy work together to evaluate the plan and make changes to it. In this way, IRPs are a key place where Minnesota’s 100% clean electricity law is implemented and have been a major focus of our Clean Electricity team for decades. (Want to learn more? We’ve got an entire explainer all about IRPs!)

In February, Xcel Energy (Xcel, or the Company) submitted its 2024 IRP, detailing its transition to a carbon-free electricity system. There is much to celebrate in this filing, and Fresh Energy and other CEOs applaud Xcel’s historic plan to decarbonize its system. However, extensive modeling and evaluation have revealed Xcel’s plan needs improvement, especially its proposal to add 2,244 megawatts (MW) of new “peaking” natural gas plants to its already significant gas fleet by 2030.

In this blog post, we’ll share the key highlights of Xcel Energy’s 2024 Integrated Resource Plan, our modeling and analysis that shows how Xcel Energy could reliably and cost-effectively use renewables, storage, and existing plants instead of building multiple new gas peakers, and how doing so would lower costs, reduce emissions, and better meet state, federal, and Xcel Energy’s own greenhouse gas reduction targets. By the end of this post, you’ll understand why we’re recommending alternatives to Xcel’s plan to add six new gas peaker plants and how we can utilize new renewables and storage and existing power plants instead.

Key highlights in Xcel Energy’s 2024 Integrated Resource Plan

Xcel is making major strides toward decarbonization, and we applaud Xcel for the following components in its Preferred Plan it filed with the Commission earlier this year:

- Continues its nation-leading plan to retire its coal fleet: Xcel upholds its commitment to retire all coal units by 2030.

- Renewable resources and energy storage: Xcel plans to invest in 3,200 MW of new wind, 400 MW of utility-scale solar, 1,100 MW of small-scale solar, and 600 MW of battery storage by 2030.

- Demand-side management: Xcel plans to invest in 1,700 MW of demand-side management by 2030, including tools to shift electricity use throughout the day to increase grid flexibility, including energy efficiency and demand response.

- Continue operating its nuclear plants: Xcel will continue operating its two nuclear plants in the state, Prairie Island and Monticello, into the 2050s. Continuing to safely operate these carbon-free, dispatchable plants is extremely valuable for helping Minnesota get to a carbon-free electric system.

Xcel’s 2024 IRP builds on its previous commitment to decarbonization by adding approximately 4,700 MW of renewables to the grid by 2030. This is an objectively ambitious plan, and the CEOs appreciate Xcel’s efforts. However, we also strongly urge Xcel to adopt a plan that depends less on new natural gas peaker plants.

Key improvements needed for cost-effective, equitable decarbonization

The new natural gas “peaker” plants in Xcel’s plan are intended to operate only 5-10% of the year to meet peak electricity demand when customer usage is high and wind and solar generation are low. Fresh Energy and other organizations in the CEOs, along with GridLab, utilized three national expert consultants—Energy Futures Group, Telos Energy, and Applied Economics Clinic—to analyze Xcel’s modeling that underlies its plan and conduct similar modeling (using the same software tools) for the CEOs. Our experts identified several changes that should be made to Xcel’s modeling, which are detailed below. Using the updated modeling assumptions, we analyzed four future scenarios (as well as re-running Xcel’s plan under our modeling assumptions) to show the tradeoffs of various modeling choices and to develop a best path forward given the uncertainty and highly dynamic nature of today’s electricity sector.

Our modeling indicates that Xcel can cost-effectively meet demand and minimize reliability risks by leveraging several of the Company’s expiring Power Purchase Agreements (PPAs) with natural gas plants already on MISO’s regional electric grid, as well as by building more renewables and storage, rather than adding over 2,244 MW of new gas peakers.

Overreliance on natural gas peaker plants: Xcel’s Preferred Plan includes 2,244 MW of new natural gas (methane) peaker plants by 2030, which would emit a significant amount of carbon pollution. These peaker plants have an assumed 40-year lifespan, and therefore risk locking-in fossil fuel infrastructure for decades, significantly complicating Minnesota’s progress toward a zero-carbon future and heightening the risk of stranded assets on its system, a risk for Xcel Energy and Minnesota customers. Finally, overbuilding natural gas peakers could make it more challenging to reach state and federal greenhouse gas (GHG) emission reduction targets, as well as Xcel Energy’s corporate commitment to provide carbon-free electricity by 2050.

Market Assumptions: Xcel’s modeling in its 2024 IRP uses a new and highly conservative approach. Specifically, Xcel’s modeling assumed that they must meet their customers’ electricity needs at all times using only its own generation portfolio—essentially operating as an island independent from our regional grid. Xcel Energy is not an island and will continue to operate not as an island but as a member of MISO’s regional electric grid. One of the primary benefits of participation in a regional grid is the ability to share reserves among many electricity providers and generators, taking advantage of resource and geographic diversity. While this may seem a small detail, it has large ramifications on the type of plan recommended by the model.

Xcel Energy is well-poised to continue participating in MISO’s marketplace: it currently has robust transmission connections to neighboring states and can also take advantage of MISO’s improving market constructs and reliability standards. For these reasons, CEOs’ modeling looked at four scenarios with different amounts of regional market interaction to show the different types of resource plans that result when you increase or decrease regional market interaction for Xcel. Again, because Xcel – like all Minnesota utilities – is a full participant in our regional electricity grid, changing the levels of market interaction in resource plan modeling is a theoretical and imperfect exercise. In this case it’s done to try to estimate how much Xcel might be relying on other generators in Minnesota and neighboring states in times of low wind and solar generation in the Upper Midwest.

To demonstrate the feasibility of a cleaner, cost-effective alternative to Xcel’s Preferred Plan, the Clean Energy Organizations (CEOs) developed an alternative Five-Year Action Plan for Xcel through extensive modeling of four different scenarios. We allowed the model to develop an optimal resource plan under four different scenarios based on the market assumption Xcel used in its last IRP: 0%, 25%, 50%, and 100% of Xcel’s previous market access assumption. We then used these results to develop a Five-Year Action Plan that balances reliability, affordability, stranded asset risk, and the need to decarbonize the electricity system by 2050.

The CEO Action Plan: a better path forward

In August 2024, the CEOs filed an alternative Five-Year Action Plan for Xcel Energy’s 2024 Integrated Resource Plan at the Commission. This plan, based on extensive research, modeling, and evaluation, concluded that Xcel Energy should not pursue six new peaker plants to meet demand and reliability needs as it transitions away from coal. Instead, CEOs found that the utility can leverage existing resources, while adding more renewable energy and storage to meet its goals for a reliable, cost-effective, and clean energy future.

The CEO Action Plan recommends that Xcel add the following resources by 2030:

- 3,800-4,800 MW of wind

- 400 MW of solar

- 800-1,200 MW of energy storage resources

- 374 MW of “dispatchable” capacity in 2028, which was approved in Xcel’s IRP and will be procured in an already-ongoing proceeding. This unit is represented by one new peaking gas plant in our modeling.

- 970 MW of generic “dispatchable” capacity by 2030, procured through a technology-neutral process and which could be met by extended contracts with existing resources.

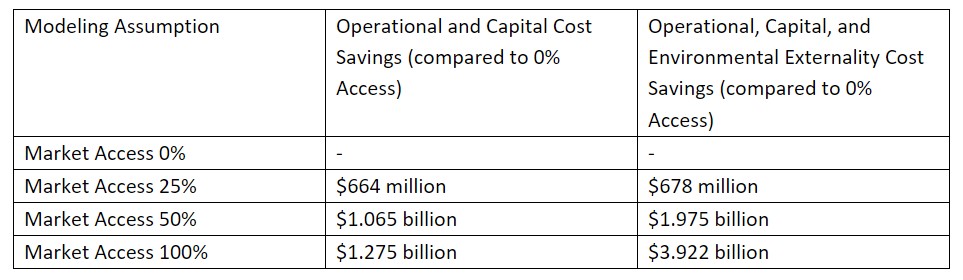

Using renewables, storage, and existing power plants has less cost risk: Our analysis found that planning as if Xcel were to operate as an island—without participating in the MISO marketplace—could cost ratepayers an additional $1.5 billion over the next 15 years. If we include the environmental externality costs of building multiple new gas peaker plants, this figure rises to $3.5 billion. By updating Xcel’s resource planning to more closely align with how it currently and will continue to operate within the MISO marketplace, our modeling finds that adding a higher level of wind power and battery storage, while leveraging one new firm dispatchable resource and contracts with existing power plants instead of building multiple new plants would create a resource portfolio with equal or lower cost compared to Xcel’s Preferred Plan.

Table 1: Cost Savings of Market Access Models, 2024-2050

Using renewables, storage, and existing power plants is a better path for emissions reductions: Our modeling found that resource plans with larger wind builds had lower emissions, due in large part to wind generation displacing gas. The 100% market access scenario contained the largest wind additions and the lowest emissions. Thus, CEOs’ recommended Action Plan contains more wind than Xcel’s proposal. This is important, especially given that the capacity factors (how much a power plant is used, both how often and at what level of its total capacity) of Xcel’s proposed gas plants and their corresponding emissions could actually be higher than is reflected in Xcel’s Preferred Plan, depending on future policy choices and the imperfect nature of modeling assumptions. The bigger picture: a plan with less new fossil infrastructure and more renewables and storage carries less risk of future emissions and preserves the opportunity for Xcel to add a meaningful amount of carbon-free dispatchable capacity in the coming decades.

Using renewables, storage, and existing power plants meets electricity needs, while minimizing cost and reliability risks: Our Action Plan meets MISO’s resource accreditation requirements, which is our regional benchmark for determining that a utility – and our regional grid as a whole — will provide adequate capacity to meet customer needs. It also shows that reasonable reliance on the regional grid and neighboring generators in addition to Xcel’s sizable existing gas fleet means that Xcel is well positioned to meet all forecasted demand. Additionally, our approach reduces the risk of stranded assets associated with new gas infrastructure, offering a more flexible and adaptive energy system with lower risk of negatively affecting ratepayers in the future.

Based on the above criteria, the CEOs strongly urge the Commission to adopt our Five-Year Action Plan for Xcel and use renewables, storage, and extended PPAs to reduce costs, emissions, and improve reliability.

Other considerations in Xcel’s long-range plan

Equity: The CEOs closely considered equity in Xcel Energy’s IRP, and we appreciate the work that was done on equity and access following Commission directives in Xcel’s last resource plan, which led to concrete outcomes like the Automatic Bill Credit Pilot Program filed by Xcel earlier this year. We urge Xcel to continue focusing on how its resource plans can benefit everyone by targeting energy efficiency efforts toward low-income communities, advancing workforce development opportunities within the clean energy economy, growing workforce diversity, and considering investment in disadvantaged communities.

Load Growth: Across the nation, utilities are increasingly faced with the prospect of new economic development, particularly in the form of large new data center loads, which has resulted in increased demand for electricity. Xcel Energy is not immune from this trend and anticipates significant load growth in the coming years, although these amounts are within the growth rates we have seen during previous periods of economic development. CEOs have provided recommendations on how to ensure clarity and certainty in new large load forecasts and improve planning and integration of new loads to ensure reliability and emissions reductions.

What’s next?

The plans and investment choices of Minnesota’s electric utilities like Xcel Energy play a large part in our state’s electricity and climate future. Fresh Energy has been engaging in utility IRP processes for the major utilities in Minnesota over 30 years, and our staff is dedicated to ensuring these plans will benefit customers, provide reliable and cost-effective electricity, and keep Minnesota on track to ambitiously meet its carbon reduction goals.

Fresh Energy, along with our CEO partners, has filed comments and our Five-Year Action Plan with the Commission, and we will continue to engage in regulatory filings and hearings on Xcel’s IRP, which will likely continue throughout this year. We anticipate the Commission will make a decision on Xcel’s IRP in early 2025.