In October 2024, the Minnesota Public Utilities Commission (PUC, or Commission) finalized a new framework requiring the state’s largest gas utilities to file Integrated Resource Plans (IRPs) every three years — a major shift in how Minnesota plans for its gas system.

Our blog post What’s up with gas Integrated Resource Plans provides a deep dive into what will be included in these plans. As we explained in the blog, gas IRPs are long-term plans in which gas utilities are required to forecast future demand, evaluate a wide range of supply- and demand-side options (from natural gas to energy efficiency, electric heat pumps, and other alternatives), and compare them on a consistent basis to ensure reliable, affordable service that aligns with climate goals.

Below, we provide updates on (1) the regulatory cost of carbon that the Commission recently decided will be incorporated into the gas IRP framework, and (2) Xcel Energy’s development of its first gas IRP under this new process.

Commission will require utilities to model three compliance cost scenarios in their gas plans

One value that utilities will account for in modeling in gas IRPs is the regulatory cost of carbon, which are the costs to comply with any regulation of greenhouse gas emissions. The value that utilities will be required to use for this cost was undecided after the gas IRP frameworks process in 2024. Therefore, the Commission opened a comment period in August 2025 to determine the appropriate data source and values for the regulatory cost of greenhouse gas emissions for Xcel Energy, CenterPoint Energy, and Minnesota Energy Resource Corporation’s upcoming gas IRPs.

Fresh Energy participated in this comment period in partnership with Minnesota Center for Environmental Advocacy and Sierra Club, recommending robust accounting of future regulatory costs related to greenhouse gases in our initial and reply comments.

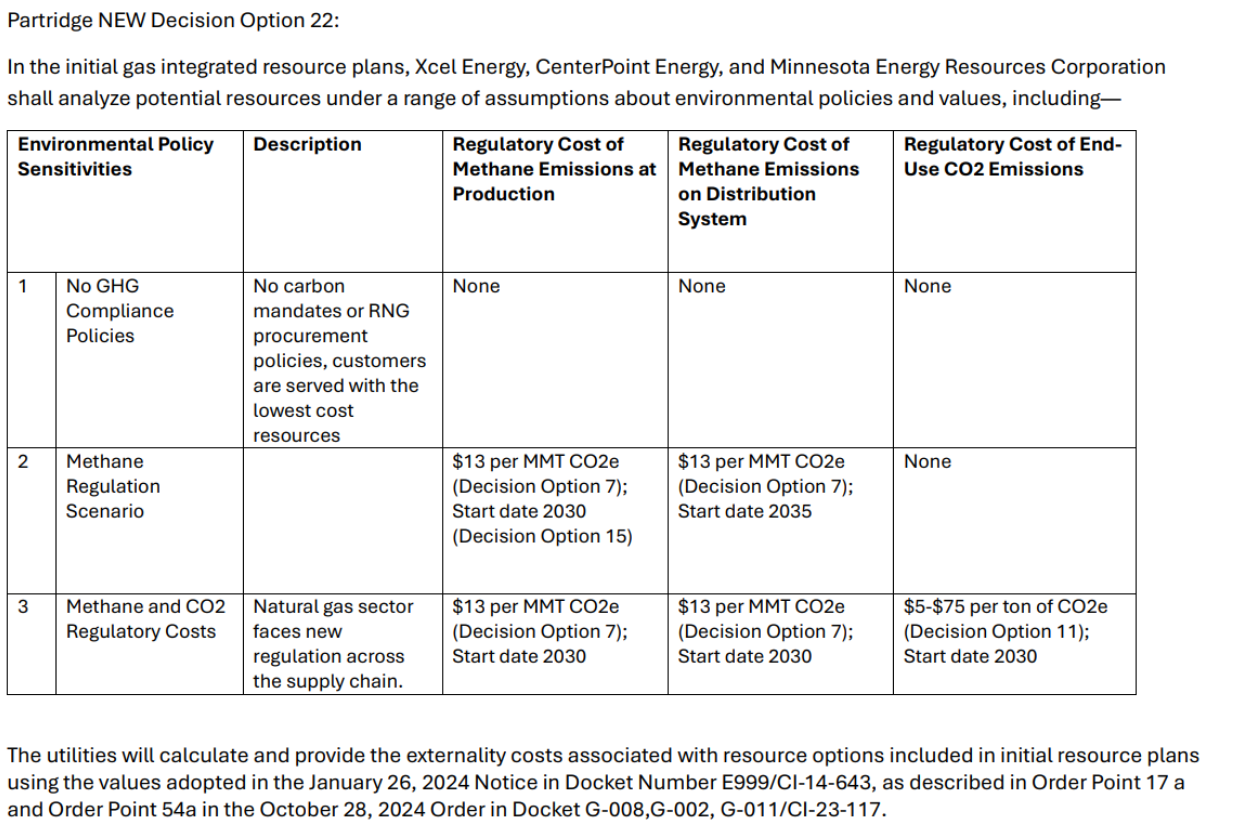

In its January 2026 decision, the Commission adopted a three-scenario framework that gas utilities must use when modeling environmental compliance costs in their initial IRPs. The scenarios are designed to test a range of potential greenhouse gas policy futures and ensure utilities evaluate risk under differing regulatory assumptions.

The first scenario assumes no new greenhouse gas compliance policies — meaning no carbon mandates or renewable natural gas procurement requirements, and no regulatory cost applied to methane or end-use CO₂ emissions. The second scenario introduces methane regulation only, applying a $13 per metric ton CO₂e regulatory cost to methane emissions from both gas production (beginning in 2030) and the distribution system (beginning in 2035), but no cost on end-use combustion emissions. The third and most comprehensive scenario applies methane costs beginning in 2030 and layers in a regulatory cost on end-use CO₂ emissions ranging from $5 to $75 per ton starting in 2030. Our recommendations were incorporated into this scenario. Utilities must use the Commission’s previously-adopted externality values when calculating these costs.

Together, these scenarios require utilities to analyze a spectrum of regulatory risk — from no carbon policy to meaningful methane and CO₂ regulation across the natural gas supply chain — strengthening the rigor of Minnesota’s first gas IRPs.

Xcel hosting workshops on its gas plan, the state’s first

Xcel Energy is in the process of developing its initial gas IRP and collecting stakeholder feedback via a series of workshops. Xcel will be the first gas utility to file an IRP by July 1, 2026.

To date, Xcel has hosted four workshops to engage stakeholder on the development of their initial gas IRP. A fifth workshop is expected for later this spring to review Expansion Alternatives Analysis and resource level analytical results. Brief overviews and materials from those workshops are provided below.

| Workshop | Date | Topic | Resources |

| 1 | May 7, 2025 | Forecasting and Next Steps Discussion topics included: • Review regulatory requirements • Customer and sales forecasting • Plan and timeline for future workshops | Link to presentation |

| 2 | August 18, 2025 | Analytical Approach Discussion topics included: • Review regulatory requirements • Discuss proposed capacity expansion planning process • Xcel Energy’s Resource Level Analytical Approach | Link to presentation |

| 3 | November 20, 2025 | Community Outreach Discussion topics included: • Capacity expansion and Expansion Alternatives Analysis process • Community climate goals and how Xcel’s resource plans impact those goals • Opportunities for future collaboration with communities that have adopted climate goals to prioritize greenhouse gas reduction investments and pilot projects | Link to recording Link to presentation |

| 4 | February 9, 2026 | Capacity Expansion Alternatives Analysis Project Identification Discussion topics included: • Presentation of identified Capacity Expansion and New Business Projects • Methodology for selecting Expansion Alternatives Analysis projects • General overview of the Company’s Expansion Alternatives Analysis methodology | Link to presentation (not posted yet) |

Five things Fresh Energy is focusing on in Xcel Energy’s first gas plan

Minnesota’s gas IRP process will only succeed if utilities rigorously evaluate the full range of cost-effective alternatives and align their plans with the state’s climate and affordability goals.

As Xcel prepares its filing, Fresh Energy will be focused on five key elements:

1. Accurate forecasting of beneficial electrification

Gas demand forecasts must realistically account for the growth of clean heating technologies, including air-source and ground-source heat pumps. Under-forecasting electrification risks overbuilding gas infrastructure that customers may not need and will ultimately pay for.

The IRP should include robust electrification adoption scenarios and reflect policy momentum at the state and local levels.

2. Comprehensive evaluation of alternatives

The plan must thoroughly evaluate a full portfolio of resources, including: energy efficiency, demand response, electric heat pumps, thermal energy networks, and thermal storage.

These resources are often lower-cost and lower-risk than traditional gas infrastructure expansion. The Expansion Alternatives Analysis process will be important in demonstrating whether proposed capacity expansion projects are truly cost-effective compared to clean alternatives.

3. Strong and actionable Expansion Alternatives Analysis implementation

Xcel has experience with evaluating non-pipeline alternatives in gas infrastructure planning, including lessons from prior and ongoing Gas Infrastructure Plan proceedings in Xcel’s service territory in Colorado. Xcel’s gas IRP should build on that experience and move beyond analysis to implementation where alternatives prove cost-effective.

Robust Expansion Alternatives Analyses should not be a procedural exercise and should meaningfully shape investment decisions.

4. Equity-centered planning and community impact

The IRP should meaningfully address equity by identifying how planning decisions affect low-income households and historically underserved communities. As required in the gas IRP framework, this includes discussing how equity was considered in developing the plan and providing narratives about equity impacts for major projects, as well as engaging and prioritizing communities that have faced disproportionate energy burdens and pollution exposure.

5. Alignment with Minnesota’s climate goals

Minnesota law requires deep greenhouse gas reductions economy-wide. Gas IRPs must demonstrate how utility investment strategies are consistent with those targets and avoid locking customers into unnecessary, long-term gas infrastructure.

Why this matters and what comes next

Gas infrastructure investments are long-lived and capital-intensive. Decisions made today will shape customer bills and emissions trajectories for decades.

The new gas IRP framework, combined with strong carbon modeling requirements, gives Minnesota a powerful opportunity to rethink how we plan the future of the gas system. If done well, this process can:

- Protect customers from unnecessary infrastructure costs,

- Improve reliability and resilience of the system,

- Reduce long-term climate risk,

- Accelerate deployment of clean heating solutions, and

- Ensure utilities are planning for a future with changing energy demand.

Fresh Energy will continue actively participating in workshops and regulatory proceedings to ensure Minnesota’s first gas IRPs set a strong precedent for thoughtful, forward-looking gas system planning.

We’ll keep you updated as Xcel Energy’s filing approaches this summer. CenterPoint Energy will be the next to file a gas IRP in July 2027, followed by Minnesota Energy Resources Corporation (MERC) in July 2028.