A version of this story was originally published in Green Tech Media.

A version of this story was originally published in Green Tech Media.

In the Great Plains, wind energy is cheap. Crazy cheap. With the lowest levelized costs approaching $10 per megawatt hour and thousands of megawatts being procured for under $20 per megawatt hour, power purchase agreements for new wind farms cost less than just the fuel required to run existing coal or natural gas plants. These economics have driven a wind boom in the region: renewable energy made up three-fourths of the new capacity built in the Upper Midwest in the last five years, and virtually all of the region’s active projects in the MISO Interconnection Queue are wind and solar farms.

In the energy policy world, much ink has been spilt discussing solar’s infamous “duck curve.” But, while solar dominates in sunny California, in the Great Plains—which are blessed with some of the best wind resource in the world—the lion’s share of renewable generation comes from wind. Will there be fearsome ducks to contend with in wind-dominant regions, or will the wind’s generation profile relegate ducks to purely sporting birds in windy regions? Last year, two days in the Upper Midwest provide a glimpse into life in a high-wind future.

Renewables in the Upper Midwest

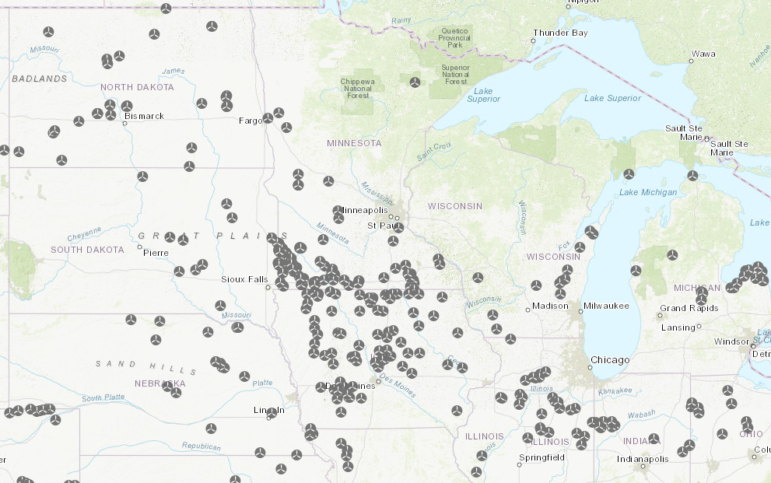

While California gets much of the attention when it comes to renewables in the U.S., the Upper Midwest has comparable levels of renewable generation. The region is peppered with wind turbines. In 2017, the MISO North Planning Zone—which includes Minnesota, Iowa, North Dakota, and parts of Montana, South Dakota, and Wisconsin—got 31 percent of its electricity from wind and small hydro, compared to about 24 percent for CAISO as a whole. At its peak in 2017, 67.6 percent of the generation in MISO North came from wind and hydro, nearly identical to CAISO’s peak renewable production of 67.3 percent.

The Smilin’ Gator Curve

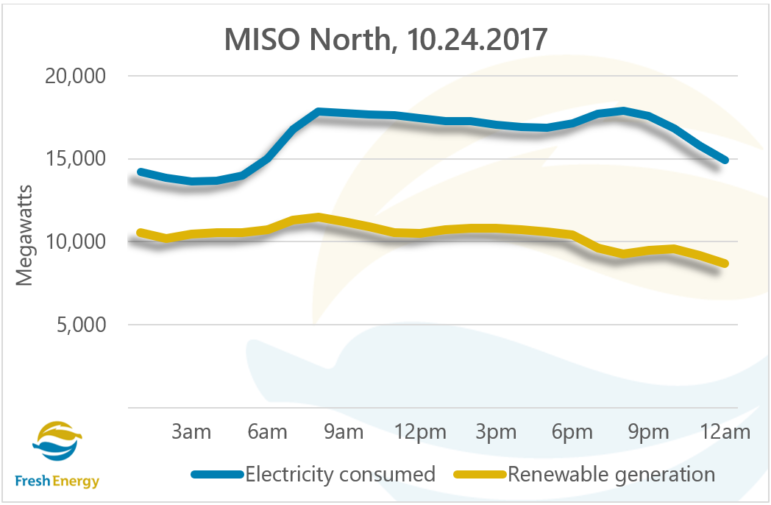

To see how high levels of wind generation affect the grid, let’s take a closer look at the 2017 peak-wind day in MISO North. On October 24, 2017, 62 percent of the electricity generated in MISO North came from renewables (almost entirely wind), topping out at 68 percent between 3 and 4 AM. The chart below shows how renewable generation (in gold) compared to electricity use (in blue) throughout the day.

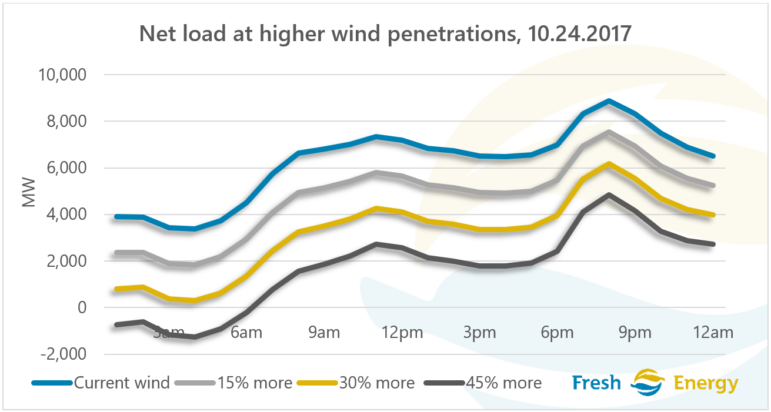

In short … there’s not much to see. Wind generation was quite stable throughout the day. Recreating the duck curve shows that MISO North would not have faced ramping issues, even with considerably higher amounts of wind generation. In fact, the morning ramp on October 24 was actually less severe with renewable generation than it would have been without. This was often the case throughout the year: of MISO North’s most severe three-hour load ramps in 2017, wind generation actually decreased the severity in eight of the top ten ramps (and two-thirds of the top fifty).

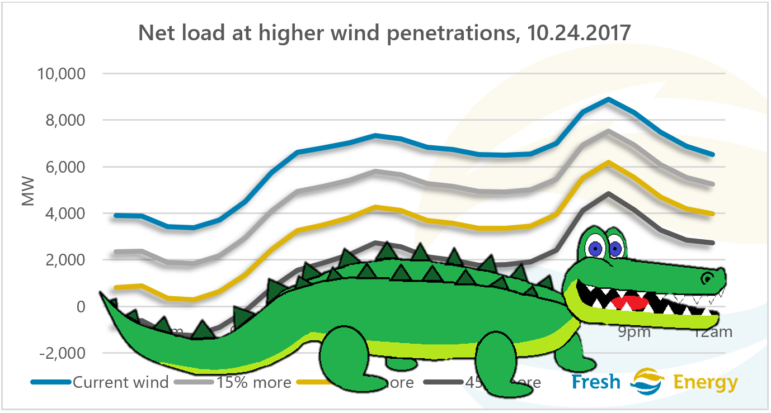

So, if we’re not duck-like, what is the Upper Midwest’s energy mascot? We give you: the Smilin’ Gator Curve. Unlike California’s ominous, faceless duck, Sally Gator welcomes the Midwest’s commitment to renewable generation!

When wind goes wild

Does this mean there’s nothing to worry about when it comes to integrating wind? Unfortunately not. Sally’s cheerful demeanor belies the challenges that lie ahead for wind-dominant regions. Unlike solar, which ramps up and down as the sun rises and falls, wind generation won’t have a consistent net load pattern like the duck curve; wind’s net load curve will vary across weeks and throughout the year. Another day later in 2017 provides a better illustration of the challenges wind can pose.

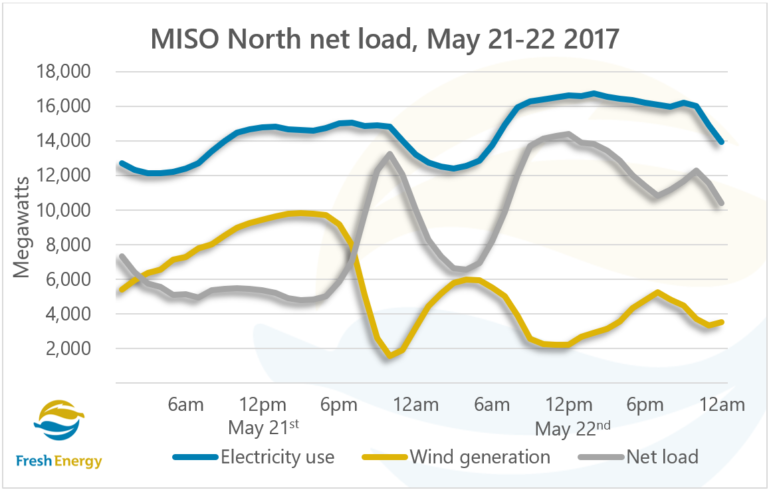

While October 24, 2017 saw the highest percentage of wind generation on the MISO North grid in 2017, renewables provided a bigger challenge to the grid on May 21 and 22. With the mild, spring weather, electricity demand was relatively flat throughout these two days, but wind generation varied dramatically. As a result, the net load spiked late in the evening on May 21, fell sharply in the overnight hours, and ramped up again in the morning of May 22. This type of pattern could pose an even greater integration challenge than a duck-like curve.

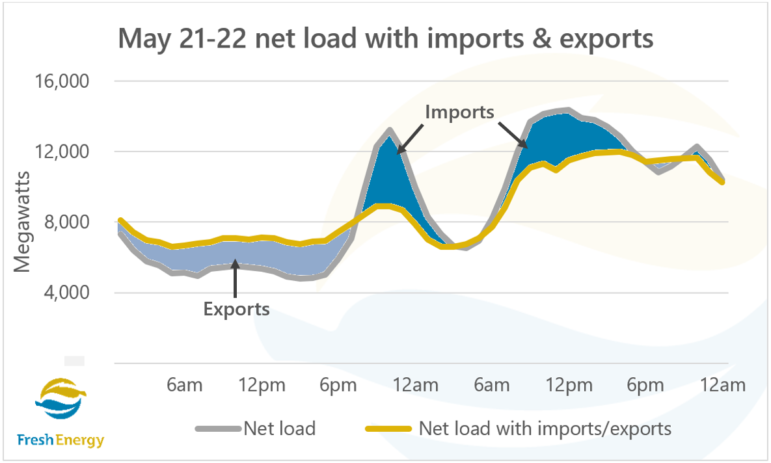

So, is this a frightening vision of things to come? Will adding more wind turn the electric grid into a dystopian hellscape?? No! In reality, MISO weathered this storm with relative ease. Since the Upper Midwest has made significant investments in transmission infrastructure, surplus wind generation can be moved throughout the region as needed.

On those days in May, imports and exports tempered the net load variability in the region to the point where other generation resources were able to meet demand with ease. Locational Marginal Prices (LMP) at the Minnesota hub peaked at just below 5¢ per kilowatt hour on May 21 and just below 6¢ per kilowatt hour on May 22. For comparison, on July 6—Minnesota’s peak day in 2017—LMPs averaged 8¢ per kilowatt hour between 2 – 7 PM, topping out at over 18¢ per kilowatt hour.

Hegemonic renewables

At today’s penetrations, integrating wind generation—even under the most trying circumstances—is manageable. Wind’s generation profile tends to be steadier throughout the day than solar’s. Though there will be days when wind creates even bigger integration challenges, these will be rarer and will tend to occur during shoulder months when there the grid has ample excess generation capacity.

Still, deep decarbonization will require getting to dramatically higher renewable penetrations, which will exacerbate challenges that are manageable today. And this transition will happen faster than most realize: there are over 10 gigawatts of solar projects and over 23 gigawatts of wind projects in the region’s portion of the MISO interconnection queue. Thanks to wind’s and solar’s complementary generation profiles, integrating a combination of wind and solar will be easier than either on its own. Moreover, geographic dispersion of renewables and advancements in wind turbine technology will further aid integration. And, as with the duck curve, demand flexibility will become increasingly valuable.

While renewables do pose integration challenges, grid operators can handle today’s levels with relative ease. As renewable penetrations rise and challenges intensify, utilities and independent system operators will have many arrows in their integration quiver. With proper planning, smart policy and market design can address challenges before they become crises. In short, we will be able to swap a pesky duck for a winsome gator.