As market demand for wind and solar continues to increase, MISO plans for the future.

Last December, I reported a 50 gigawatt (GW) gap between a projected 2030 market demand for renewable energy in the 15-state Midcontinent Independent System Operator (MISO) market and the actual as of December. As I reported, projected demand for renewable energy in the wholesale market by 2030 is estimated at 30 percent of total energy (requiring 69 GW of renewable energy capacity) and the status as of December 2019 was only 19 GW of renewable energy in service. This left a hefty gap for MISO to fill and at the time there was no transmission plan or planning process in place that anticipated the need to interconnect new renewable energy resources at a scale needed to meet climate goals and market demand. Today I can report a much-improved situation – on three fronts.

1. 50 GW Then, 30 GW Now

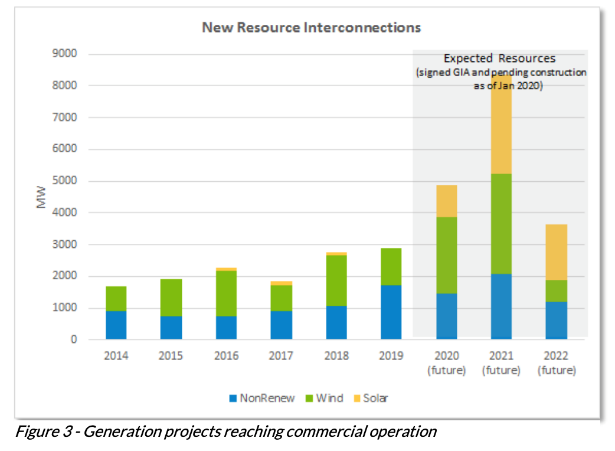

In addition to the 2 GW that has been placed in service since December 2019, a significant number of new renewable energy projects have made it through the interconnection process. These were not accounted for in my December blog. According to MISO’s John Lawhorn, 9.7 GW of new wind and 6.6 GW of new solar projects are approved and ready to be built or are already under construction. If you add these new renewable energy resources (16.3 GW) to the existing fleet of renewables (21.8 GW) MISO will be at 38.1 GW in the next year or so, provided these projects are all successfully completed. (See MISO figure 3 below) Add to that a reported 1.9 GW of distributed energy resources and the MISO region is in reach of 40 GW of renewable energy resources.

On top of that, there is a new wave (5+ GW) of storage and hybrid projects (combinations of wind, solar, and storage) that are under study. These innovative projects are demonstrating new, beneficial ways that renewables can interact with the MISO market, paving the way for a significant expansion of these new technologies.

2. MISO Futures Now Factor In Carbon Reduction

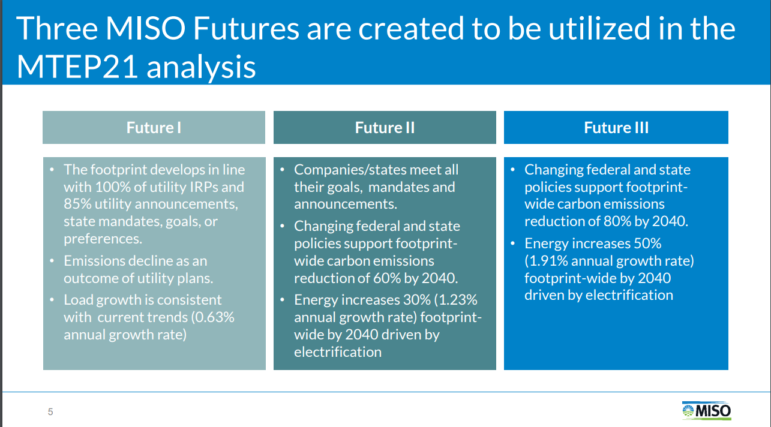

MISO recently finalized the three planning scenarios or “futures” to be used in its MTEP21 studies. The MTEP (MISO Transmission Expansion Plan) stakeholder engagement process is what MISO uses to determine needs and cost allocation for transmission expansion. The futures are scenarios using a long-term planning horizon that have varying assumptions for load growth, resource additions and retirements, and their locations. MISO combines the results of these scenarios in such a way as to arrive at a no regrets expansion plan with transmission solutions needed within the next five to 10 years. For the first time, the scenarios include reasonable assumptions for carbon reduction driven by government energy policy and rapidly increasing electrification of the energy economy.

Significant challenges remain as MISO and its stakeholders continue with the process. The next step is to look at geographic configurations of the evolving generation fleet to co-optimize the investments in transmission and generation. Then there’s cost allocation. While MISO has cost allocation tariffs in place that determine who benefits and who pays for the transmission additions, it is expected that there will be a debate over whether the current tariffs are appropriate for the projects that come out of MTEP21 and whether a new tariff needs to be developed. In any case, cost allocation must be resolved before the MTEP21 projects can be approved in December 2021.

3. Only Integrated Planning Can Capture the Multiple Benefits of Transmission Additions

In addition to the above futures, MISO has also just released its 2020 Queue Outlook report for resources looking to interconnect to the MISO grid. In it, MISO acknowledges that the rapidly changing marketplace (reflected in the futures) will necessarily drive significant transmission investment to reliably and economically meet resource addition needs. According to the report,

“A comprehensive approach for long-range transmission planning and generation interconnection planning provides the best opportunity for successful system planning by recognizing broader benefits of transmission reinforcements and enabling integration of new resources to support specific policies and goals of stakeholders…”

This kind of comprehensive, integrated, long-range planning has been missing from the MTEP process in the past and would be a welcome new development. Working with its stakeholders, MISO is now considering the development of a comprehensive planning process that can fully capture multiple benefits that transmission additions can offer with the rapidly changing dynamics in the energy markets. This will ensure the most cost-effective transmission build-out. It is critical that MISO’s planning process look for transmission solutions that can simultaneously address the multiple needs on the system in the most efficient way to keep costs as low as possible for consumers.

Another positive development on the planning front came on May 29, 2020, when CapX2020, a group of ten transmission owners in Minnesota, Wisconsin, North and South Dakota, Iowa and Illinois formally requested that MISO to undertake just such a study within the MISO “Classic” subregion.

While all of this is very good news, market trends and the scenarios themselves are indicating that demand for renewable energy, and potential growth in demand for electricity through electrification, will drive the need for additional renewable energy resources beyond 30 percent or 69 GW. While the cutting edge CapX2020 and MISO MVP initiatives were highly successful and can serve as examples of innovation and collaboration for today’s stakeholders, the lesson learned from those initiatives is that it’s critically important to anticipate policy and market trends – not make plans based existing markets and policies. Transmission development has a long planning horizon, taking five to 10 years from planning to completion. MISO stakeholders will need to fully engage in the MTEP21 process and make sure it doesn’t shoot behind the mark.

*In its most recent estimates MISO has revised downward slightly the number of GWs needed to reach 30 percent of total energy from 69 to 62 GW. This number will vary depending on assumptions for load growth.

Fresh Energy is committed to ambitious action to speed the transition to a clean energy economy. Will Kaul, our clean energy transmission consultant, has nearly four decades of professional energy experience and provided crucial leadership on CapX2020, a collaboration of 11 utilities that jointly planned and built a $2.1 billion, 800-mile expansion of the high voltage electric grid serving a large region in the Upper Midwest. We are proud of our work to secure that first round of infrastructure, but it’s not enough. Will, Fresh Energy, and our partners are now working to secure the new investments we need to drive innovation and unlock the full potential of wind and solar in Minnesota and the Midwest.