Fresh Energy is committed to equitably decarbonizing Minnesota’s economy by midcentury, and a crucial part of that effort is addressing emissions from the natural gas distribution system used to heat buildings (including our homes and businesses) and power gas appliances.

One of the key regulatory frameworks guiding this transformation in Minnesota is the 2021 Natural Gas Innovation Act (NGIA), which allows certain gas utilities to submit innovation plans that outline how they will reduce greenhouse gas (GHG) emissions from the natural gas system.

In 2023, CenterPoint Energy and Xcel Energy, the two largest gas utilities in Minnesota, have submitted their first innovation plans to the Minnesota Public Utilities Commission (PUC, or Commission), setting a critical precedent for the state’s gas decarbonization framework.

However, while Minnesota is taking its first steps in transforming its natural gas distribution system, these initial filings differ significantly compared to how other states are implementing more ambitious, cost-effective plans.

Without stronger action, Minnesota risks under-investing in cost-effective resources like beneficial electrification and geothermal and not meeting its GHG reduction targets. Minnesota has the opportunity to lead from the North in decarbonizing its natural gas distribution system and serving as a model for how the Midwest can decarbonize its gas system in a cold climate.

In this blog post, we will:

- Compare Minnesota’s NGIA framework to the regulatory structures used in other states. We’ll examine which states have set or proposed clean heat regulatory frameworks or plans, how these plans are allocating funding toward alternative fuels, and explore how utility costs are passed on to ratepayers.

- Take a closer look at Xcel Energy’s proposed NGIA plan in Minnesota and compare it to their approved Clean Heat Plan in Colorado. This comparison highlights how the same utility is pursuing starkly different strategies in the two states, and how that risks leaving Minnesota behind. JUMP TO SECTION

- Briefly analyze the NGIA proposals submitted by Xcel Energy and CenterPoint Energy in Minnesota, and what these plans mean for the future of gas decarbonization in the state. JUMP TO SECTION

Gas decarbonization plans: a state-by-state comparison

Across the nation, states are developing new policies to cost-effectively reduce short-term and long-term emissions from the natural gas distribution system. These policies, often called clean heat regulatory frameworks or plans, seek to create a flexible yet enforceable framework for utilities to decrease GHG emissions by investing in clean heat technologies, while offering consumer choice and incentivizing market innovation. Similarly, many states are also opening “Future of Gas” dockets at their state utility commissions to investigate the role of the natural gas distribution system during the energy transition.

Clean heat regulatory frameworks and plans vary significantly from state to state, reflecting local policy priorities and energy needs. Each state’s approach involves a mix of resources, often including electrification, geothermal, carbon offsets, and alternative fuels like renewable natural gas (RNG) and hydrogen, but the specific measures, scope, and compliance mechanisms between states can differ greatly.

A comparison of how different states are investing in clean heat resources, and how those costs are passed on to ratepayers, can offer valuable insights, which we’ll explore further below.

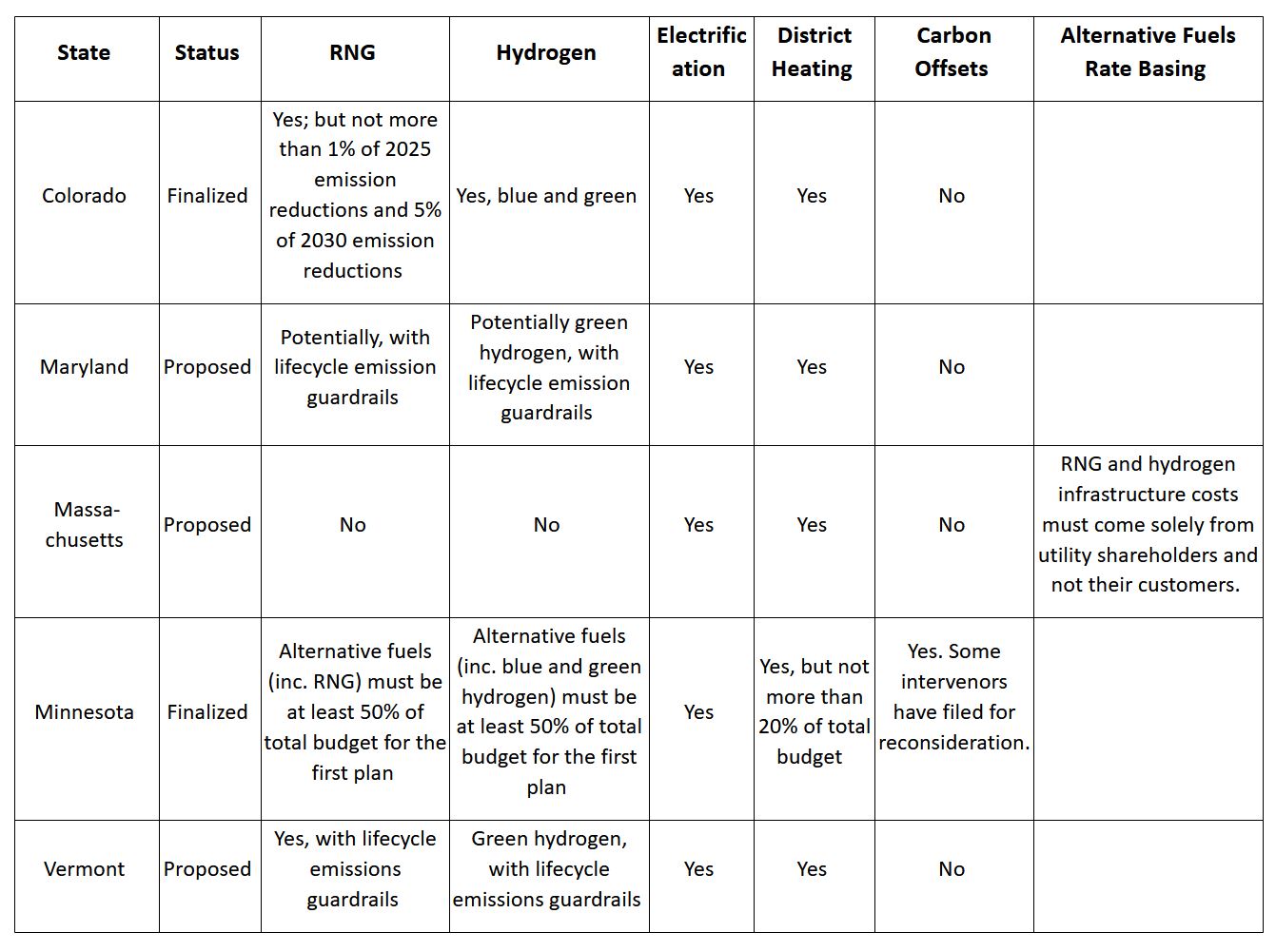

Table 1: Clean heat laws passed by legislatures: clean heat resources and allocations

- California has enacted several rulemakings to study and implement building decarbonization, long-term gas planning, electrification, and demand flexibility through electric rates based on its Clean Energy and Pollution Reduction law to reduce GHG emissions by 40% by 2030 and 80% by 2050, based on 1990 levels. In September 2024, it launched a new regulatory proceeding to advance decarbonization in its long-term gas planning and explore near-term actions to decarbonize.

- Colorado’s Clean Heat Standard law was enacted in 2021, and the Colorado Public Utilities Commission approved its first utility plan implementing the standard in 2024. While the law offers broad flexibility of resources — including electrification, gas demand-side management, geothermal, RNG, hydrogen, and carbon offsets — the Colorado Public Utilities Commission notably did not fund hydrogen or carbon offsets in its first approved plan, citing cost and emission concerns, and hardly funded RNG (only 2% of the approved budget). Instead, the approved clean heat plan invested heavily in electrification (56% of the approved budget) as well as geothermal and gas demand-side management, funding fuel switching at a 50/50 allocation between gas and electric customers. Colorado’s Clean Heat Standard is explored in-depth in the section below.

- Illinois proposed a clean heat and decarbonization standard bill during its 2024 legislative session, but it has not yet passed into law.

- Maryland enacted its “Climate Solutions Now Act” law in 2022 to reduce GHG emissions to 60% below 2006 levels by 2031 and achieve net-zero emissions by 2045. Based on these binding requirements, the Maryland Department of the Environment (MDE) proposed how a Clean Heat Standard might work to the Greenhouse Gas Mitigation Working Group of the Maryland Commission on Climate Change with help from Regulatory Assistance Project, according to EFG. MDE has been administering this rulemaking process in 2024 and is expected to have draft regulations before 2025; it will include both gas utilities and heating oil and propane importers as obligated parties in its framework.

The program proposed a credit system, will provide opportunities for networked geothermal, and — notably — will potentially allow alternative fuels for high-heat applications on a lifecycle emissions analysis. Unlike Colorado, which only regulates distributed fuels like natural gas, it also regulates importers of delivered fuels like heating oil and propane, similar to Massachusetts and Vermont. At this time, eligible resources include weatherization, electrification, certain biofuels, RNG, wood heating, and networked geothermal, but not offsets. Its credit system will be measured on a net lifecycle basis and only includes resources delivered in the state.

Also based on the Climate Solutions Now Act, the Maryland Commission on Climate Change recommended the state’s Public Service Commission have electric and gas utilities submit plans showing how they will meet the state’s GHG reduction targets. The Maryland Office of People’s Counsel filed a petition in 2023 asking the PSC to open a new docket to consider near- and long-term planning for gas companies. The PSC opened a docket (Case Number 9707) to consider this request and is currently collecting public comments. - Massachusetts in 2021 established, via Executive Order No. 596, a first-in-the-nation Commission on Clean Heat to begin drafting a Clean Heat Standard. A framework was released in 2022, and the Massachusetts Department of Environmental Protection (MassDEP) has released draft regulations and opened a stakeholder process to implement the standard.

Simultaneously, the Massachusetts Department of Public Utilities just concluded a three-year investigation into how utilities gas utilities can reduce emissions via its Order 20-80 Future of Gas docket. Taken together, Massachusetts has opted for simplicity instead of flexibility: the state is rapidly transitioning to electrification and geothermal to meet its heating needs and notably does not allow gas utilities to use ratepayer money to fund alternative fuels, like RNG or hydrogen blending, or carbon offsets.

In November 2024, the Massachusetts Legislature passed a bill that changes the definition of a gas company from only delivering fossil fuels to also providing heating and cooling to homes through networked geothermal, a step forward in advancing decarbonization. - Minnesota passed its Natural Gas Innovation Act in 2021, which created a regulatory framework at its Public Utilities Commission for utilities to file NGIA plans (also called innovation plans) as well as directed the Commission to open a Future of Gas docket. Notably, the law enacted strict allocation limits for utilities’ first innovation plans: a minimum of 50% of budget costs must go toward alternative fuels like RNG and hydrogen, and a maximum of 20% toward geothermal.

In contrast to other states, Minnesota allows carbon offsets (though intervenors have filed for reconsideration) and allows credits associated with RNG to be purchased from outside of the state. Minnesota approved its first utility innovation plan in Summer 2024 and is currently considering another utility’s innovation plan; a detailed analysis of these innovation plans is provided below. Minnesota also recently finalized the frameworks for gas utility Integrated Resource Planning (IRP) for the state’s three largest gas utilities. - Nevada opened a Future of Gas docket in 2021, known as its long-term gas planning regulatory framework. In 2024, it began considering its first integrated resource planning requirement for utilities in the state, similar to Minnesota.

- New Jersey proposed a clean heat and decarbonization standard bill during its 2024 legislative session, but it has not yet passed into law.

- New York enacted the Climate Leadership and Community Protection law in 2019, committing the state to reducing emissions 40% from 1990 levels by 2030 and at least 85% by 2050. As a result, New York’s Public Service Commission, which regulates the utilities that own and operate gas distribution networks, must ensure gas utilities are compliant with the law. This law also established the Climate Action Council to set a roadmap to achieve its emissions reduction targets; it developed a Scoping Plan that will be embodied in the state’s next State Energy Plan, which is binding guidance on the Public Service Commission, according to BDC. This long-term planning will affect how gas utilities make investment decisions that align with the state’s emissions reduction targets, including forecasts of gas demand, supply forecasts, emissions reporting, and more. In 2022, New York passed the Utility Thermal Energy Network and Jobs Act (UTENJA), which enables gas and electric utilities to own, operate, and manage thermal energy networks, following the lead of Massachusetts and Minnesota in 2021.

- Oregon Department of Environmental Quality passed its Climate Protection Program (CPP) in 2021, which requires Oregon’s fossil fuel suppliers, including gas utilities that are regulated by the Oregon Public Utility Commission, to achieve emission reductions of 50% by 2035 and 90% by 2050, though it was invalidated by the state’s second-highest court in December 2023. The PUC opened a Future of Gas docket (UM 2178, the “Natural Gas Fact-finding Investigation”) to reduce consumer risk while gas utilities meet climate pollution reduction goals. Oregon has not yet enacted a Clean Heat Standard, though in 2024 the Oregon Public Utilities Commission rejected all three gas utility’s long-term plans for not meeting the state’s GHG emission targets and being “unreasonably optimistic” about future natural gas demand amidst the energy transition, relying too much on RNG and synthetic natural gas, which is chemically similar to natural gas but can be derived from coal, biomass, and other substitutes.

- Rhode Island opened a Future of Gas docket in 2022 to study how to reduce GHG emissions from its natural gas distribution system.

- Vermont passed a Clean Heat Standard law in 2023 and its Public Utilities Commission recently released draft rules, after which it must be approved by the Legislature in 2025 to be enacted. While this standard is in development, it creates a clean heat credit system where thermal energy providers (both gas utilities and fuel delivery entities) will buy, sell, and trade credits. It also has strict guardrails for alternative fuels: it allows them, but they must meet lifecycle carbon intensity levels that will ratchet down over time — which includes measures like GHG emissions, health impacts, land use changes, ecological and biodiversity impacts, and impacts on air, water, and soil. Vermont is unique in that only about 20% of households use piped utility gas; most buildings are heated with delivered fuels like fuel oil, propane, wood, and kerosene.

- Washington has opened a docket about gas utility decarbonization and in 2024 passed its Gas Utility Decarbonization law to enable a managed transition of the natural gas distribution system.

- Wisconsin has begun long-term energy planning in its Public Service Commission but has not instituted a Clean Heat Standard or Future of Gas docket.

A tale of two states: Xcel’s Energy’s significantly different gas plans in Minnesota and Colorado

Though Xcel Energy is the second-largest gas utility in Minnesota and the largest in Colorado, their gas decarbonization plans for the two states differ starkly: while Xcel’s Colorado plan prioritizes electrification for its low costs and emissions, its Minnesota NGIA plan has very little.

Xcel’s approved Clean Heat Plan in Colorado invests heavily in electrification, with little to no funding for recovered methane, hydrogen, or carbon offsets

In 2021, the Colorado Legislature passed SB21-264 which set up a regulatory framework for their Commission to oversee gas utility plans to decarbonize the natural gas system. The law directs gas utilities, including Xcel Energy, to develop Clean Heat Plans to cost-effectively and reliably decarbonize the natural gas distribution system. It calls for a 4% reduction in GHG emissions by 2025 and a 22% reduction by 2030.

Notably, SB21-264 gives utilities broad flexibility in designing their Clean Heat Plans.

The law’s only allocation cap is for recovered methane (Renewable Natural Gas, or RNG), stating that no more than 1% of its 2025 total emissions reductions and no more than 5% of its 2030 total emissions reductions can be met through RNG projects. It allows utilities discretion over how to allocate the rest of their clean heat resources, including: energy efficiency, biomethane, hydrogen, beneficial electrification, cost-effective leak reductions, and others.

Xcel filed its first Clean Heat Plan with the Colorado Public Utilities Commission (Colorado Commission) in August 2023. After a thorough review process with multiple stakeholder interventions, the Colorado Commission approved a modified version of the plan in June 2024. Xcel initially presented four different portfolios in its Clean Heat Plan, and the Commission opted to modify Xcel’s plan rather than adopt any of the proposed versions in full.

Xcel’s approved Clean Heat Plan in Colorado is ambitious, cost-effective, and sets the utility on a good path toward decarbonization.

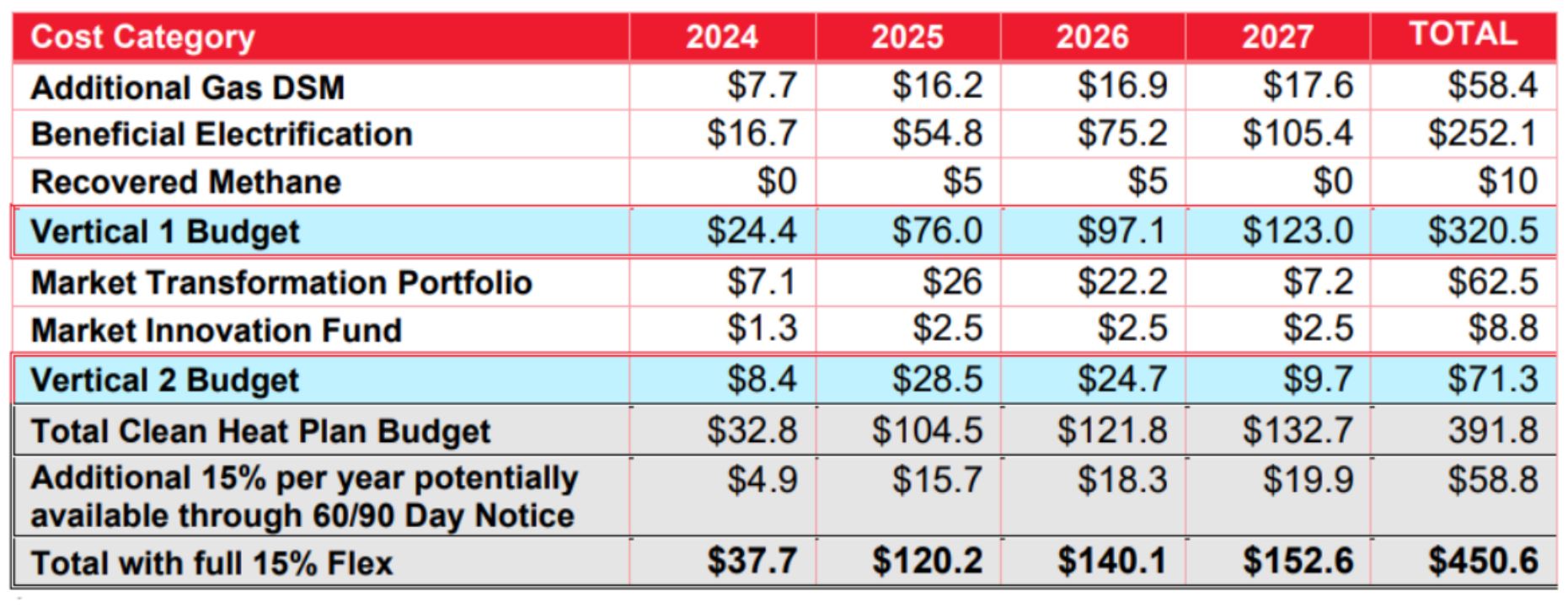

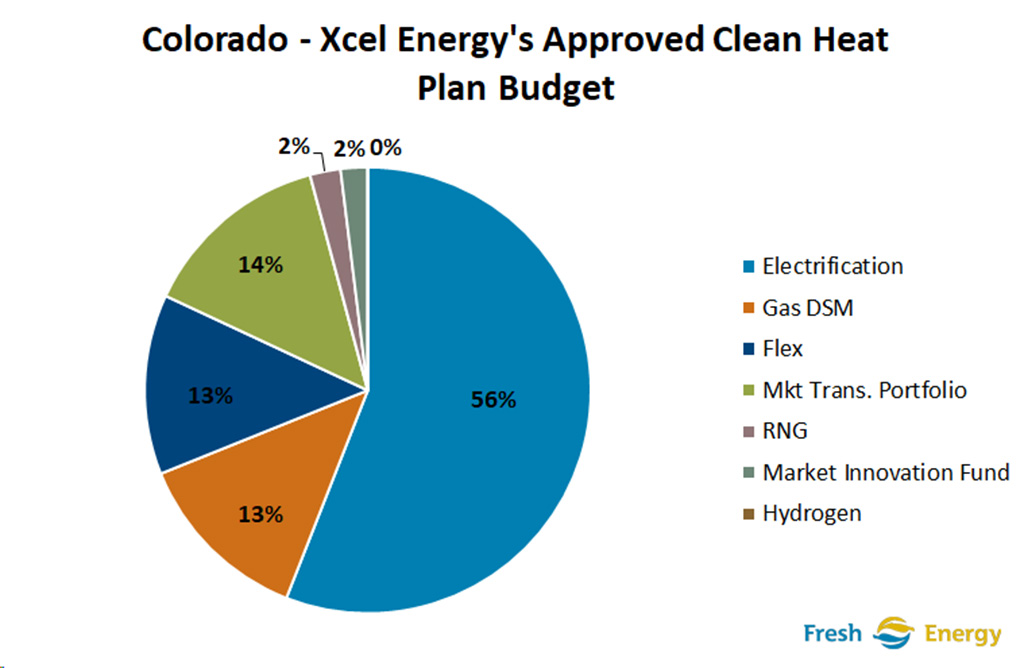

The Colorado Commission directed Xcel to spend most of its budget on beneficial electrification and gas demand-side management, and to invest only minimally in alternative fuels. Of the total $450.6 million budget, $252.1 million of it goes toward beneficial electrification (56%), followed by $58.4 million for gas demand-side management (13%), with the Commission noting the plan “prioritizes and maximizes the use of building electrification and demand-side management, which the record reflects are the most cost-effective clean heat resources.”

The Commission also required that 20% of building electrification and demand-side management spending be allocated toward income-qualified customers and disproportionately impacted communities, advancing equity.

Notably, the Colorado Commission did not find RNG, hydrogen, or carbon offsets to be cost-effective resources to decarbonize its gas system. It designated only $10 million for RNG (2%) and did not allow any funding for hydrogen or carbon offsets. This decision reflects the Commission’s understanding that electrification, not alternative fuels, is the most cost-effective strategy for reducing emissions in Colorado’s natural gas distribution system.

With regard to hydrogen, the Commission noted that hydrogen has “too many open questions regarding system compatibility, … additional infrastructure or infrastructure costs, … and actual emission reduction potential.”

The Commission also rejected Xcel’s proposal for a pilot project comprised of carbon offsets and some RNG, noting “the price … could significantly undercut the price of clean heat resources that actually do reduce emissions from the distribution and end-use combustion of gas, which is the Commission’s main priority and statutory directive.”

In contrast, the Colorado Commission was supportive of all-electric new construction and networked geothermal. Xcel proposed a $5 million pilot project, the All-electric New Build Initiative, to build 50-100 all-electric homes.

The Commission not only approved the pilot project but increased the funding by six-fold to $32 million to build several hundred homes instead, noting that “all-electric new construction offers the most cost-effective opportunities to simultaneously reduce both LDC emissions and capital expenditures.”

The Commission was “disappointed that that [sic] the Company is proposing such a limited pilot program,” and stated that “electrification of new construction is the ‘low hanging fruit’ of avoiding emissions on the gas system.”

Finally, the Commission strongly encouraged but did not require Xcel to look for opportunities to incorporate ground-source heat pumps and networked geothermal into the pilot project. Xcel’s Colorado plan is a clear signal that electrification is the future of gas decarbonization.

The Commission rejected significant investments in RNG, hydrogen, and carbon offsets, emphasizing that these technologies are not cost-effective compared to electrification and do not provide the same public health and GHG reduction benefits.

Put simply: the Colorado Commission found that the most cost-effective and emissions-lowering plan for Xcel was to invest in electrification and not invest in alternative fuels and carbon offsets.

Xcel’s proposed innovation plan in Minnesota invests in renewable natural gas and hydrogen, with very little funding for electrification

In the same year Colorado passed the Clean Heat Plan legislation, Minnesota passed the Natural Gas Innovation Act (NGIA), creating a similar framework to Colorado’s Clean Heat Plan. However, the structure of Minnesota’s NGIA has some key differences.

Unlike Colorado, which gave utilities broad flexibility in budget allocation, Minnesota’s NGIA requires that at least 50% of the utility’s costs in its first (note: only the first) innovation plan be directed toward alternative fuels, like RNG, biogas, green hydrogen, and ammonia.

Additionally, no more than 20% of the budget can be allocated to district energy system pilots. This strict allocation sets Minnesota’s approach apart from Colorado’s more flexible strategy. Furthermore, NGIA plans aren’t tied to a specific GHG emissions reduction target for gas utilities the way that Colorado’s Clean Heat Plans are.

There’s also a key difference in cost caps between Colorado and Minnesota.

In Colorado, SB21-264 requires the Colorado Commission to establish a cost cap for Clean Heat Plans of 2.5 percent of annual gas bills for all full-service customers as a whole. Xcel Colorado calculated this to be, on average, $34 million annually, or $136 million from 2024-2027.

However, the Colorado Commission approved a plan with a budget that significantly exceeds the cost cap, stating that they “find that a plan exceeding the cost cap is in the public interest because such a plan is necessary to put the Company on track to meet the 2030 statutory target. . .”

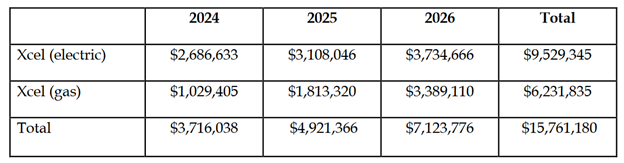

In Minnesota, the annual total incremental costs of NGIA plans are limited to the lesser of: (1) 1.75 percent of the utility’s gross operating revenues from natural gas service provided in Minnesota at the time of plan filing; or (2) $20 per non-exempt customer. The aggregate cost cap that Xcel calculated for its NGIA petition is $58 million over the five-year plan term (2025-2029), or $12 million per year.

This difference in statutory cost caps means Colorado can spend nearly three times as much a year on implementing its Clean Heat Plans compared to Minnesota’s NGIA plans, and that the Colorado Commission has the flexibility to approve plans with budgets that exceed the cap.

Whereas Xcel’s Colorado plan will invest in cost-effective electrification, its Minnesota proposal starkly contrasts by going well above the 50% fuels requirement (for first plans) while barely supporting electrification.

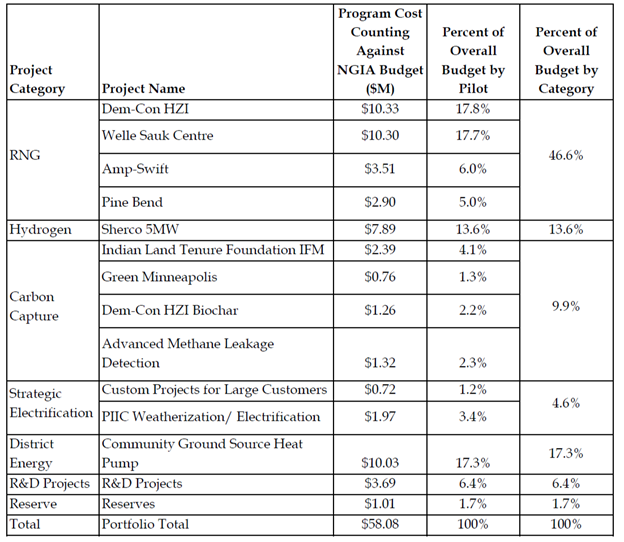

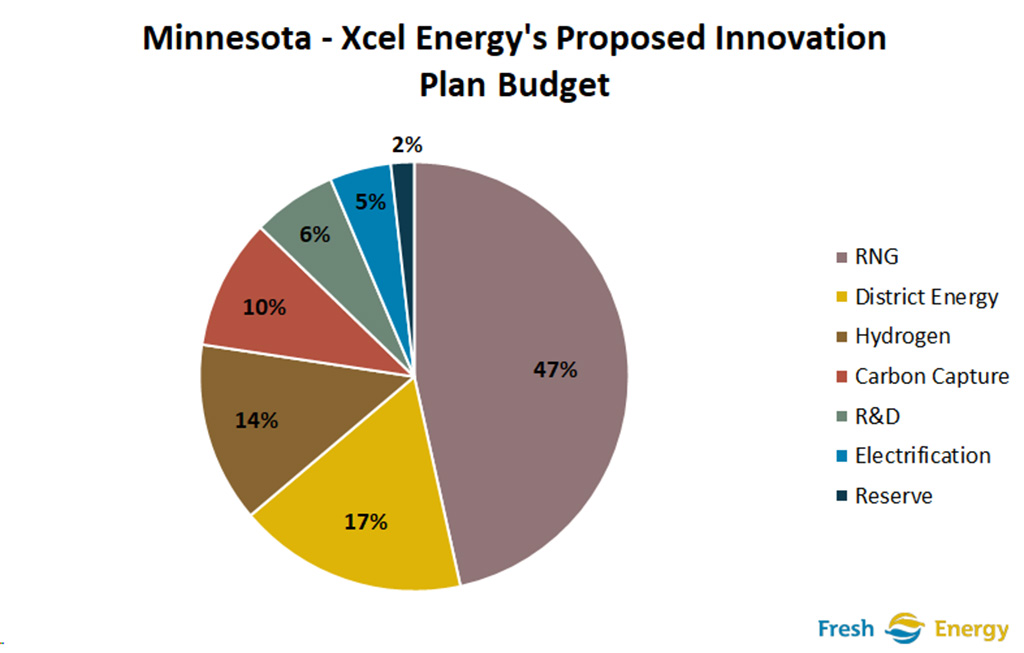

In its proposed innovation plan with the Minnesota Commission, Xcel Energy has allocated only $2.7 million (or 4.6%) of its total budget toward electrification and $10.0 million (17.3%) toward district energy (networked geothermal). Instead, the bulk of its budget is directed toward RNG ($27.0 million, or 46.6%) and hydrogen ($7.9 million, or 13.6%), totaling 60.2%, — above the 50% required by NGIA. Additionally, Xcel proposes $5.7 million (9.9%) for carbon capture initiatives.

Table 3. Xcel Energy’s proposed NGIA budget by pilot and project category in Minnesota

Fresh Energy believes that Minnesota would benefit from a more balanced approach, where funding for alternative fuels is set at 50% (the statutory minimum), and the remaining budget is used to maximize investments in geothermal systems (up to 20%) and beneficial electrification.

As was the case with Xcel’s Clean Heat Plan in Colorado, we believe that beneficial electrification is the most cost-effective method for reducing GHG emissions and gas system throughput, and it aligns with Minnesota’s GHG emissions reduction targets.

Minnesota risks overpaying and over-emitting in Xcel’s proposed NGIA plan, and we’d be better served with a plan that invests more in electrification and geothermal, like Colorado.

The Colorado Commission found electrification to be the most cost-effective resource for decarbonizing its gas system, allocating $252.1 million ($306 million if the electrification projects in the Market Transformation Portfolio are included). That is over 100 times more than Xcel’s proposed $2.7 million for electrification in its NGIA plan in Minnesota.

Similarly, the Colorado Commission warned against excessive investment in alternative fuels, emphasizing that they were not cost-effective and lacked the emissions and air quality benefits of electrification.

The Commission allocated only $10 million (2%) of its budget toward RNG and none for hydrogen or carbon offsets. In contrast, Xcel’s Minnesota plan proposes 70% of its budget for alternative fuels and carbon offsets.

While Xcel must meet Minnesota’s statutory requirement that 50% of its innovation plan focus on alternative fuels, we believe that allocating the voluntary 20% toward electrification would better serve the state’s cost-effective decarbonization efforts.

Xcel is not maximizing its spending on efficient fuel-switching in ECO

Xcel Energy has justified its small amount of spending on electrification in its NGIA plan by insisting that Energy Conservation and Optimization (ECO), rather than NGIA, is the best vehicle for electrification and energy efficiency. (Check out our short explainer on ECO, Minnesota’s landmark energy efficiency framework for utilities!) Yet, Xcel is also not spending nearly enough on electrification and energy efficiency in ECO, either.

As shown below in Table 3 below, in its approved 2024-2026 ECO Triennial plan, Xcel is not maxing out its spending on efficient fuel-switching to its statutory budget caps. These spending caps have since been removed due to legislation passed during the 2024 session, removing a restriction on utilities’ opportunities to invest in electrification in ECO.

Even prior to the removal of the spending cap, Xcel was only spending 23% of its electric spending cap and 48% of its gas spending cap in 2024, and 27% and 85% of its respective electric and gas spending caps in 2025.

Furthermore, much of the spending Xcel is investing in efficient fuel-switching isn’t directly funding rebates for heat pumps to electrify heating but instead funding the electrification of lawn equipment and indirect activities such as advertising and promotion of electrification efforts.

Table 4: Xcel’s approved efficient fuel-switching budget in its 2024-2026 ECO Triennial plan

Xcel’s total efficient fuel-switching budget in its 2024-2026 MN ECO Triennial plan only amounts to 6% of Xcel’s budget for beneficial electrification in its 2024-2027 CO Clean Heat Plan.

In addition to the monies for gas energy efficiency and beneficial electrification approved in Xcel’s Clean Heat Plan, the Colorado Commission has previously approved an additional $215 million in spending on these resources through the 2023 Demand-Side Management and Beneficial Electrification Strategic Issues proceeding in May of 2023.

According to the Southwest Energy Efficiency Project, Xcel now has $644 million to invest in energy efficiency and beneficial electrification over the next three-and-a-half years. If the existing investments in beneficial electrification in Xcel’s Strategic Issues are factored in ($125 million), Xcel’s efficient fuel-switching budget in Minnesota only amounts to 4% of the beneficial electrification spending that Xcel is doing in Colorado.

Given the substantial investments in electrification and energy efficiency that Xcel is making in Colorado, it is clear that Xcel needs to invest significantly more in electrification and energy efficiency in ECO, especially since Xcel is proposing to invest minimally in these resources in its initial NGIA plan with the justification that ECO is the more appropriate vehicle for those investments.

A closer look at Minnesota’s gas plans: Xcel Energy and CenterPoint Energy

Fresh Energy is engaging with Xcel Energy’s NGIA plan at the Minnesota Public Utilities Commission. We previously engaged in CenterPoint’s NGIA plan, which has concluded. We provide a brief overview of the plans below, including details about what we support and what we feel can be improved to cost-effectively meet our state’s GHG reductions targets at the pace required.

CenterPoint’s approved innovation plan in Minnesota has room for improvement

In July 2024, the Commission approved CenterPoint’s NGIA plan, making it the first utility in Minnesota to submit and receive approval.

As Minnesota’s largest natural gas provider serving over 920,000 customers, CenterPoint’s five-year plan marks a significant milestone in the gas system’s transformation and advances some measures that provide alternatives to natural gas.

CenterPoint’s approved plan includes several positives initiatives. Clean Energy Organizations (CEOs) including Fresh Energy, the Minnesota Center for Environmental Advocacy, and the Sierra Club North Star Chapter, engaged in the docket at the Commission and expressed support for CenterPoint’s efforts on electrification and energy efficiency.

These investments are critical steps toward GHG emissions from buildings. Additionally, CenterPoint’s $11.6 million investment in a networked geothermal heating system, where homes share a geothermal heat source via geothermal heat pumps, is an innovative pilot program. This pilot program will provide valuable insights into scaling geothermal systems, which the CEOs see as a crucial climate solution.

However, there are significant aspects of the plan that the CEOs believe could have gone further.

While we welcome the additional reporting requirements that will help stakeholders evaluate pilot programs, the plan does not fully maximize opportunities to reduce natural gas throughput in a timely and effective manner. This is essential for meeting Minnesota’s climate goals.

Some elements of the plan raise concerns. For instance, CenterPoint is allowed to purchase RNG from outside Minnesota, which does little to grow the local market or benefit Minnesota-based producers.

Additionally, we see issues with subsidizing natural gas heat pumps and new natural gas appliances in hybrid heating systems, as well as the outsized focus on carbon offsets and hydrogen blending.

The Commission also approved CenterPoint’s proposal to spend $4.6 million on a hydrogen plant in Mankato, which will blend hydrogen into the gas distribution system. While hydrogen blending is touted as a clean option, its environmental benefits are limited, and we believe hydrogen would be better deployed in sectors where electrification is not feasible, such as heavy industry.

While the NGIA dictates that 50% of innovation plan budgets must be for alternative fuels such as RNG and hydrogen, Fresh Energy notes that this allocation only applies to this first innovation plan and there is no fuels requirement for future plans. Minnesota would be best served to follow other states’ clean heat plans in shifting a much larger portion of future budgets toward beneficial electrification instead.

Xcel Energy’s proposed innovation plan in Minnesota underperforms compared to its Colorado counterpart

While we compared Xcel Energy’s proposed innovation plan budget to the utility’s approved Colorado plan above, we will briefly detail its proposed Minnesota plan below.

In August 2024, Fresh Energy and other CEOs filed initial comments in response to Xcel Energy’s first NGIA plan in Minnesota. Xcel’s plan was the second gas innovation plan filed in Minnesota, following CenterPoint Energy’s.

While the plan introduces some promising pilots, we believe Xcel’s approach to decarbonizing its natural gas system falls short in key areas, especially when compared to the utility’s approved plan in Colorado.

We appreciate several aspects of Xcel’s proposal, particularly their efforts to keep RNG procurement within Minnesota, in contrast to CenterPoint’s allowance for out-of-state RNG purchases. Xcel’s plan includes strategic pilots for electrification, such as a networked geothermal project, which focuses on beneficial electrification at the community level. Additionally, Xcel plans to use green hydrogen for industrial customers, a significantly more appropriate application than blending hydrogen into the gas distribution system. These steps align with best practices for decarbonization.

That said, several aspects of the plan can and should be revised to maximize benefits for customers and more fully meet the intent of the NGIA. Similar to CenterPoint’s NGIA plan, Xcel’s plan lacks an objective standard for assessing the effectiveness of its GHG emission reduction measures.

Minnesota law calls for economy-wide emission reductions of at least 50% by 2030 and 100% by 2050, relative to 2005 levels. Xcel’s plan proposes to reduce emissions by 6% over the next five years, but this does not reflect the urgency of the climate crisis. An objective standard is crucial to ensure that utilities are held accountable for making meaningful progress toward state targets.

Moreover, we believe Xcel should prioritize and increase investments in electrification and energy efficiency, rather than focusing so heavily on alternative fuels and carbon offsets.

Xcel is proposing to allocate nearly 60% of its budget to RNG and hydrogen, which is more than what is necessary under NGIA. In Colorado, Xcel allocated nearly 60% of its budget to beneficial electrification instead, budgeting only 2% toward RNG and 0% toward hydrogen after the Commission found alternative fuels would not cost-effectively and meaningfully reduce GHG emissions compared to electrification.

Xcel’s allocation comes at the expense of more cost-effective and scalable solutions like electrification and efficiency measures, which deliver direct benefits to customers and reduce GHG emissions more effectively.

Xcel’s budget for carbon offsets is also concerning, as offsets do not reduce the amount of geologic gas delivered to customers. The Colorado Commission declined Xcel’s request to allocate any budget for carbon offsets, citing concerns over the unregulated nature of the offset industry and doubts about whether they would meaningfully reduce emissions at a cost-effective rate for customers.

In October 2024, Fresh Energy and other CEOs filed supplemental comments on Xcel’s NGIA plan.

If the Commission does not require that Xcel include additional electrification and energy efficiency pilots (such as thermal energy storage, deep weatherization/building envelope measures, industrial electrification, and/or all-electric new construction) in its initial NGIA plan, we recommended that it should require that the Xcel file them as proposed updates to its 2024-2026 ECO Triennial plan. This is critical to ensure that the needed investments in electrification are actually made and not kicked from one docket to another through arguments that they are better implemented elsewhere.

Xcel and the Department have indicated that ECO is the preferred vehicle for electrification and energy efficiency. Therefore, the Commission should ensure Xcel makes these electrification investments in the vehicle Xcel itself has identified.

A hearing at the Minnesota PUC on Xcel’s initial NGIA plan is expected in February 2025.

What’s next?

Both CenterPoint and Xcel’s NGIA plans represent important steps toward decarbonizing Minnesota’s natural gas system, but there is significant room for improvement. As Fresh Energy continues to engage in these regulatory proceedings, we are advocating for stronger investments in electrification and energy efficiency, and for strategies that reduce natural gas throughput in a way that aligns with Minnesota’s GHG reduction targets.