The age of wind power has arrived. As technology has advanced and the industry has matured, the cost of wind generation has plummeted, to the point where wind is now the lowest-cost resource in the upper Midwest. But, as more wind has been added, market prices have fallen, especially during overnight hours with lower electricity demand.

In a previous post, we argued time-of-use pricing will boost wind development by increasing demand for electricity during times of high wind generation. In this post, we walk through a simplified electricity market to show how this works.

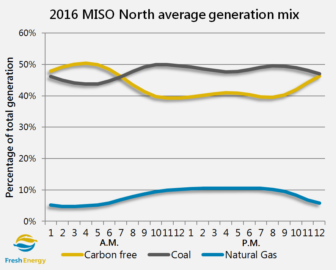

Electricity generation throughout the day

The chart to the right shows how our electricity generation mix changes throughout the day. Wind production is typically highest overnight, when electricity demand is lowest. So, in the early morning hours, electricity is “cleaner,” as most of our electricity comes from carbon-free sources (the gold line). During the day, however, wind generation is typically lower, and coal (black line) and natural gas (blue line) plants ramp up to meet the peak demand; this means carbon emissions per-kWh are higher during the day.

The chart to the right shows how our electricity generation mix changes throughout the day. Wind production is typically highest overnight, when electricity demand is lowest. So, in the early morning hours, electricity is “cleaner,” as most of our electricity comes from carbon-free sources (the gold line). During the day, however, wind generation is typically lower, and coal (black line) and natural gas (blue line) plants ramp up to meet the peak demand; this means carbon emissions per-kWh are higher during the day.

To this point, some advocates have been skeptical that time-of-use pricing will decrease carbon emissions. Some argue that shifting load from day to night could mean running more coal plants instead of natural gas plants, and may actually improve the economics of coal generation, which could slow down the pace of coal retirements.

Electricity markets background

While this is a reasonable concern in a vacuum, it overlooks the dynamic nature of electricity markets. By focusing so closely on the very near-term, this argument loses perspective on the long-term effect on the grid from a good time-of-use pricing policy.

Before I explain why, we first need some background on how electricity markets work. Minnesota is part of the Midcontinent Independent System Operator (MISO), which controls the markets for electricity in the region. Each day, MISO develops a forecast of the electricity demand for the next day, at 5-minute increments. Electricity generators submit “bids” for each 5-minute period. MISO then matches the bids to the forecast by “stacking” the bids for a given time period from lowest to highest and selecting the lowest bids needed to meet the demand. The highest accepted bid sets the “market clearing price”; all generators that are selected will receive this price for their generation, regardless of their actual bid. The bid that set the price is referred to as the “marginal” unit, because it was the bid that was on the margin; had electricity demand been slightly lower, that generation would not have been needed, and the next lowest bid would have been the marginal unit.

Electricity market example

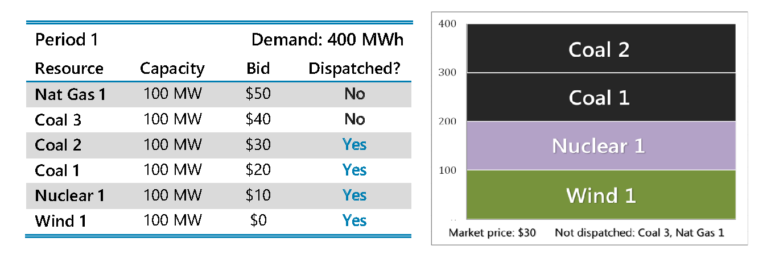

With this in mind, let’s look at a simplified example of an electricity market. Imagine a market with just six generation resources—one nuclear, one wind, three coal, and one natural gas—each with 100 MW capacity and no transmission constraints. Now imagine an overnight hour with relatively low demand (400 MW). For this period, here’s how each generation resource bid into the market (left) and the resulting resource “stack” (right).

For this hour, “Coal 2” is the marginal unit, so its bid ($30/MWh) sets the market price. Wind 1, Nuclear 1, Coal 1, and Coal 2 are each paid the market-clearing price of $30/MWh, and Coal 3 and Natural Gas 1 were not dispatched, because their bids were too high. If demand had been lower (e.g. 300 MW), Coal 1 would have been the marginal resource with a price of $20/MWh and Coal 2 would not have been dispatched. And if demand had been higher (e.g. 500 MW), Coal 3 would have been the marginal resource, with a market-clearing price of $40/MWh.

This last point illustrates some advocates’ concern: if we were to shift more demand into this overnight hour, we would have to add generation from a coal unit to meet the demand. Moreover, shifting load from a high-demand daytime hour might mean dispatching another coal unit overnight instead of a natural gas unit in the afternoon. It may also improve the economics of coal generation, which could extend the useful lives of existing coal units.

This argument overlooks the big-picture market dynamics in a changing electricity landscape. Our electricity generation is undergoing a dramatic transition. Coal plants are being retired at a breakneck pace: since 2010, nearly half of the nation’s coal plants have either been retired or have announced a retirement date. Meanwhile, wind capacity in the U.S. has grown from under 7GW in 2004 to over 80 GW in 2016, and a new turbine is being added every 2½ hours! Technological advancements have dramatically reduced the price of wind power, to the point where it is now the least-cost resource in the upper Midwest, with long-term contracts being secured for less than 2¢/kWh.

In this context, focusing solely on the near-term impacts of load shifting loses the forest for the trees. Let’s go back to the hypothetical to see why.

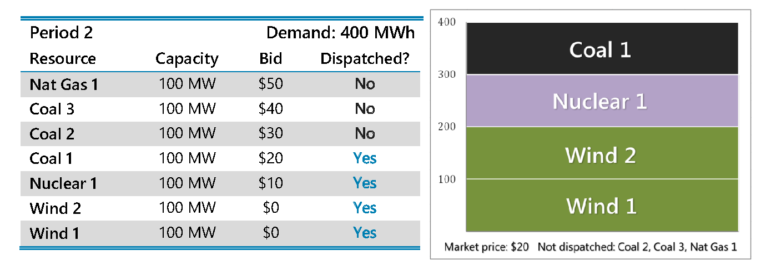

Imagine a new wind developer was watching our hypothetical market closely. She sees that the market price of $30/MWh is more than what it would cost her to install a new wind farm. So, she decides to build a new 100 MW wind farm (Wind 2). The demand for electricity is the same (400 MW), but now there are seven generation resources in the mix, with the following bids (left) and resource “stack” (right):

This time, Coal 1 is the marginal unit, which reduces the market clearing price from Coal 2’s bid ($30/MWh) to Coal 1’s bid ($20/MWh). And since all generators receive the market-clearing price, Wind 1 and Wind 2 now receive less for their energy than they would have in Period 1.

Time of use rates

These examples illustrate a few important points: first, all else equal, adding more renewables drives down market prices. Wind has no fuel cost, so it very rarely sets the market clearing price. And as more wind is added to the system, fossil fuel resources that would have been dispatched are pushed out of the money, which lowers the market price. This is great for consumers, who pay less for their electricity. It’s also great for the environment: in our example, the resource mix went from half coal and half carbon-free in Period 1 to one quarter coal and three quarters carbon free in Period 2. But, it’s bad for wind developers, as eventually the market gets to the point where prices are so low that adding more wind is no longer cost-effective.

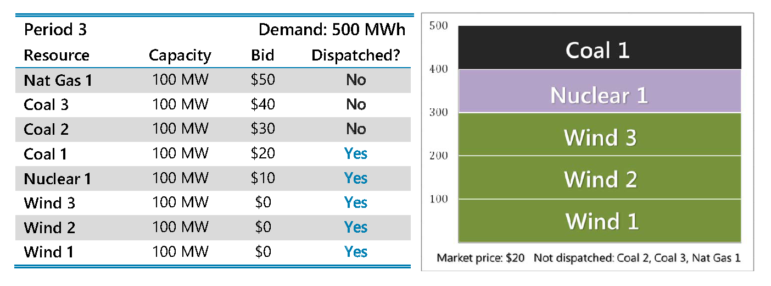

This is where time-of-use pricing comes in. Shifting demand to times of low load and high wind production will increase the amount of wind that can be added cost-effectively. Using the example above, increasing demand to 500 MWh would allow another 100 MW wind project to be added while maintaining a market-clearing price of $20. Here’s what the bids (left) and resource stack (right) would look like:

This hypothetical is, admittedly, overly simplified; the actual MISO North market is much more nuanced and complex. However, the general principles outlined above hold true. (If you would like to explore a more detailed and realistic example, see the University of Texas at Austin’s excellent Merit Order calculator for Texas’ equivalent of MISO, which shows how fuel prices and renewable development affect market prices).

The wind market in the upper Midwest has evolved, and our policy advocacy needs to adapt to this new environment. While the goal—adding as much renewable energy as possible—remains the same, we must identify policies that will move the wind industry (and the jobs and local tax revenue it provides) from a plucky upstart to a hegemonic force. Time-of-use pricing is one opportunity: shifting load will improve grid efficiency and lower electric rates, but it will also spur more cost-effective wind development and a more carbon-free electricity fuel mix over time. Looking forward, new, flexible electric loads like electric vehicles and electric water and space heating offer even greater potential, as they can be controlled in real time to optimize the integration of intermittent renewable resources.