In several recent filings before the Minnesota Public Utilities Commission, Minnesota’s rate-regulated electric and gas utilities have requested changes to the rates they charge customers to recover costs of providing service. Through these and other proceedings, rate design has become a primary focus of utility policy due to its impact on how customers use and pay for the energy they receive. Fresh Energy has provided analysis, testimony, and recommendations in these proceedings to ensure rates encourage energy efficiency and allow fair compensation for onsite generation like solar.

Setting customer rates

In particular, the issue of marginal costs has driven the policy debate in Otter Tail Power’s ongoing rate case and the Commission’s proceeding on alternative rate designs. Marginal costs are an established component of economic theory, and when applied correctly can lead to fair and effective rate design. The Commission has recognized this by stating that rates shall be based on marginal costs in its rate design objectives.

Because of the monopolistic nature of utility companies, determining rates to charge their customers can be a contentious issue. Regulating utilities involves many different models that can quickly become overwhelming without a solid foundation in economics. An important tool in rate design includes marginal cost determination and pricing. Basing prices on marginal cost can be beneficial assuming these points:

- Rates must be efficient and fair for all parties involved

- Rates must present accurate price signals for consumers

- Social costs must be considered

What is marginal cost?

Marginal cost is the cost to produce one more unit of a good. In pure marginal cost pricing, prices will be set at this level. Marginal costs include every cost incurred to bring that one more unit to the market. If producing one more kWh requires building a new wind turbine, that turbine is included in the marginal cost. This is marginal cost at its most basic level. It seems straightforward, but there are many different circumstances that play a role in the determination of this price that create complexity.

Markets or Monopoly

First, it is important to recognize that marginal costs are different for a natural monopoly when compared to more competitive markets. In a competitive market, firms compete with each other for market power and will naturally drive costs to marginal cost levels, which is the cheapest option that still recovers all costs associated with production. Any firm that is unable to produce its goods at this level will be driven out of business. This is not the case for natural monopolies, such as electric utilities. In these situations, prices are driven up if more producers are present due to the high costs of entry into the market. For example, if there were two vertically-integrated electric utilities serving St. Paul, then there would need to be two sets of generation, distribution, and transmission infrastructure to support the two companies and only half the population to pay for it. This duplication would make everything much more expensive!

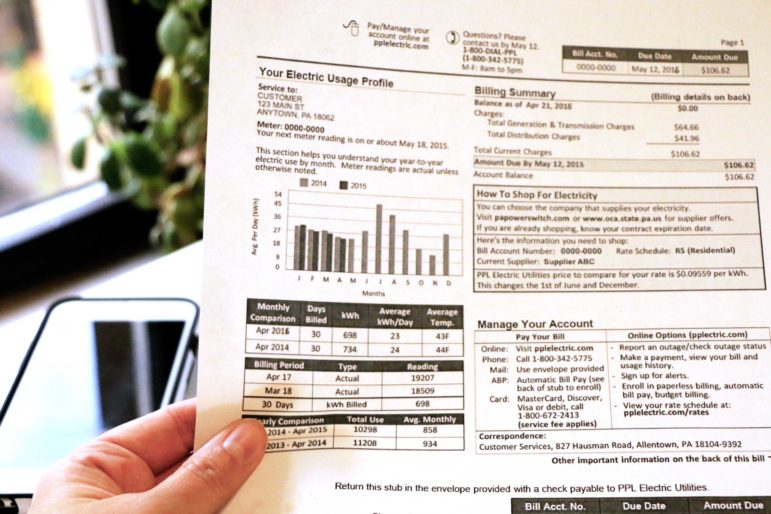

For regulated monopolies, determining fair prices can be difficult. This is due to the large upfront costs discussed above. Pricing strictly at marginal cost for electricity would eliminate the incentives for utilities to operate, as they would be operating at a loss. Losses would occur because the marginal costs of an additional unit of output are minimal and do not account for the high cost of investment in infrastructure necessary to enter the market. Natural monopolies exist precisely because average total cost will always be above marginal cost. This phenomenon allows these organizations to take advantage of economies of scale. As more and more people purchase electricity from a utility, the cost of infrastructure is spread out among more people. This is why we see the two-part tariff pricing structure on our electricity bills: a fixed monthly fee and a volumetric charge in the form of a dollar-per-unit of energy used. The monthly fee is intended to cover certain fixed costs faced by the monopoly. The variable charge then covers the cost to produce and deliver energy driven by how much customers use. The debates in rate design often arise from disagreements on which specific costs to include in the fixed and variable charge.

Fixed or variable charges

Because fixed charges provide certainty in utility revenues utilities will often seek a higher fixed charge instead of seeking higher per unit energy charges. However, recovering a higher proportion of revenues in the fixed charge compared to recovering that revenue in the energy charge is not in customers’ best interests. Simple changes in behavior can lead to lower bills. Keeping fixed charges low allows customers to see how their usage patterns effect their bills and allows them to see quantifiable benefits when implementing conservation and energy efficiency measures.

The idea of diminishing marginal utility represents this situation perfectly. In this case, diminishing marginal utility indicates people value each additional unit of energy less than the previous one. For example, the benefit of having lights on in rooms you are not using is not valued as highly as having lights on in the room you are in. Those extra units of energy you use during a month are not as valued as the first units to provide the most basic services. People can change their usage patterns to reduce their bill by turning lights off or purchasing more energy efficient lighting. This is often a significant consideration when regulators set prices because higher fixed costs are of greater benefit to the utility and its shareholders, but are less related to customers’ actual behaviors.

Calculating the true cost

Another major problem that utilities face when determining marginal cost pricing is calculating social costs. It is accepted economic theory that the true marginal cost includes social costs. Social costs include the private cost to the firm in production combined with the externalities borne from that process. In the case of electricity generation, negative externalities can be part of the true cost of production to society. Negative externalities can include health problems, environmental degradation, and displaced populations due to the waste created by energy production. These externalities often go unaccounted for in the cost of electricity. This means we have not reached the socially optimal point of production in regards to electricity generation, since these costs are unfairly placed on the shoulders of people who are not involved in production of the good.

For example, if water resources in an area are contaminated due to pollution, individuals not involved in creating that pollution will face increased costs to secure clean water. Because customers are not considering these costs while consuming electricity, they are not facing accurate price signals on the true cost of electricity. This is a market failure since the cost of electricity does not include all costs associated with production, leading to excessive consumption. Until social costs are accounted for in cost determination, consumers are not facing accurate price signals for the production of the next unit of electricity.

For consumers, marginal cost pricing is a very useful pricing tool that presents the true cost of the good they buy. It also allows customers to see how a change in their behavior can affect the size of the monthly bill. When fairly incorporated into utility rate design, marginal costs that account for social costs can provide effective price signals to customers as well as fairly recover utility costs to provide service. Fresh Energy will continue to drive economic principles in utility rate design that incentivize efficient use of energy and fairly compensate onsite customer generation options.